rutor-kek.ru

Recently Added

Agricultural Investment

Agricultural Investments Under International Investment Law International investment law, based primarily on international investment treaties, plays an. The CSM Working Group will continue to interface with the CFS process of consultation to develop “guidelines on responsible agricultural investment”. Looking for Agricultural Financing? We serve a diverse land ownership base combining our farm, ranching, and timber backgrounds to provide a variety of loan. We offer a revolutionary investment model where investors can own managed almond farmlands in Spain with a year management guarantee. Our vision is a thriving commercial African agriculture sector that benefits both people and planet. Investee Explore our investment criteria to see how we. Agricultural investments are an often overlooked sector. But they can potentially diversify and strengthen your portfolio's performance. Many studies show that investment to increase productivity of owner-operated smallholder agriculture has a very large impact on growth and poverty reduction. Our Stakeholders & Investors. Our investments in farmland and food processing assets seek to minimize future environmental risks and make our funds more. 6 Investing in agriculture and food systems can produce multiplier effects for complementary sectors, such as service or manufacturing industries, thus further. Agricultural Investments Under International Investment Law International investment law, based primarily on international investment treaties, plays an. The CSM Working Group will continue to interface with the CFS process of consultation to develop “guidelines on responsible agricultural investment”. Looking for Agricultural Financing? We serve a diverse land ownership base combining our farm, ranching, and timber backgrounds to provide a variety of loan. We offer a revolutionary investment model where investors can own managed almond farmlands in Spain with a year management guarantee. Our vision is a thriving commercial African agriculture sector that benefits both people and planet. Investee Explore our investment criteria to see how we. Agricultural investments are an often overlooked sector. But they can potentially diversify and strengthen your portfolio's performance. Many studies show that investment to increase productivity of owner-operated smallholder agriculture has a very large impact on growth and poverty reduction. Our Stakeholders & Investors. Our investments in farmland and food processing assets seek to minimize future environmental risks and make our funds more. 6 Investing in agriculture and food systems can produce multiplier effects for complementary sectors, such as service or manufacturing industries, thus further.

From buying farmland to investing in the commodities markets, there are various potentially lucrative investment opportunities. We invest in croplands and make private equity and debt investments in associated commodity processing assets further up the agricultural value chain. Purpose, Vision, Values. Illume Agriculture is a farmer first asset management company with a relentless pursuit of excellence for all its stakeholders. Our. We invest in agriculture across sub-Saharan Africa and South Asia because research shows that growth in the agricultural sector is the most effective way to. Agricultural investment is –3 times more effective in increasing the income of the poor than is non-agricultural investment. But it is important to note that. Our Agricultural Finance Group is an active provider of mortgage financing, with a total agricultural mortgage loan portfolio of $ billion. Investing in agricultural commodities such as grains, livestock, and fruits has historically generated high returns for investors. We have a track record of delivering investment strategies that seek to generate attractive risk-adjusted returns, and are helping develop solutions to. Development Projects: AGRICULTURAL SECTOR INVESTMENT PROGRAM - P Agricultural Investments Under International Investment Law International investment law, based primarily on international investment treaties, plays an. The regulations require foreign investors who acquire, transfer, or hold an interest in U.S. agricultural land to report such holdings and transactions to the. The author argues, but to realize this potential developing countries must close the gap between capital available for agricultural expansion and their. The CSM Working Group will continue to interface with the CFS process of consultation to develop “guidelines on responsible agricultural investment”. We offer customized, vertically integrated, sustainable agricultural investment solutions across commodity types and geographies. Find out more about. What is Agricultural Investment? Definition of Agricultural Investment: The expenditures on agriculture including short-term costs as well as long-term. IFPRI provides evidence and analysis to identify country-specific goals and targets, investment priorities, and policy options to guide NAIP development. While many institutional investors are familiar with the investment opportunities associated with financing private real estate, most tend to focus on. The Investment Services Branch helps investors set-up their agri-business smoothly and quickly in Alberta. Agri Investor covers private investment in farmland, forestry, agriculture and food technology, processing, storage, water and agribusinesses. Private sector investment can play a vital role in delivering inclusive economic growth, environmental sustainability and poverty reduction.

Ira For Self Employed Person

A simplified employee pension (SEP) is an individual retirement account (IRA) that an employer or self-employed individual can establish. · Small businesses and. Whether you are self-employed or own a small business, self-directed SEP IRAs can help maximize your retirement savings by investing in alternative assets. When you're self-employed, you can save for retirement with tax-advantaged accounts like a SEP IRA, self-employed (k), SIMPLE IRA, or Fidelity Advantage. Independent contractors, the self-employed, and gig workers can take advantage of tax-sheltered savings programs to secure their futures, even without. If the self-employed person does have employees, all employees must receive the same benefits under a SEP plan. Since SEP-IRAs are a type of IRA, funds can be. It's best to set up monthly automatic deductions from your bank account to your Roth IRA. Small, regular contributions over time can help your returns. 4. It's. A Charles Schwab SEP-IRA is one of the easiest small business retirement plans to set up and maintain. Learn more about SEP-IRA possible tax benefits today! Retirement Plan Options When You're Self-Employed · Solo (k) plans · Individual retirement accounts (IRAs), both Roth and Traditional · Simplified Employee. 4 retirement planning options if you're self-employed · 1. Traditional and Roth IRAs · 2. SIMPLE and SEP IRAs · 3. Solo (k) · 4. Health Savings Account (HSA). A simplified employee pension (SEP) is an individual retirement account (IRA) that an employer or self-employed individual can establish. · Small businesses and. Whether you are self-employed or own a small business, self-directed SEP IRAs can help maximize your retirement savings by investing in alternative assets. When you're self-employed, you can save for retirement with tax-advantaged accounts like a SEP IRA, self-employed (k), SIMPLE IRA, or Fidelity Advantage. Independent contractors, the self-employed, and gig workers can take advantage of tax-sheltered savings programs to secure their futures, even without. If the self-employed person does have employees, all employees must receive the same benefits under a SEP plan. Since SEP-IRAs are a type of IRA, funds can be. It's best to set up monthly automatic deductions from your bank account to your Roth IRA. Small, regular contributions over time can help your returns. 4. It's. A Charles Schwab SEP-IRA is one of the easiest small business retirement plans to set up and maintain. Learn more about SEP-IRA possible tax benefits today! Retirement Plan Options When You're Self-Employed · Solo (k) plans · Individual retirement accounts (IRAs), both Roth and Traditional · Simplified Employee. 4 retirement planning options if you're self-employed · 1. Traditional and Roth IRAs · 2. SIMPLE and SEP IRAs · 3. Solo (k) · 4. Health Savings Account (HSA).

Vanguard will continue to offer a one-person SEP-IRA. An Individual(k)—also known as Individual (k)—maximizes retirement savings if you're self-employed or. Self-employed individuals can deduct their IRA (Individual Retirement Account) contributions as a tax deduction. However, only traditional IRA contributions. The annual limits on contributions to your own SEP-IRA are the same that apply to your common-law employee's SEP-IRAs. However, self-employed persons must. A SEP IRA is a type of tax-advantaged retirement account that is available to self-employed people or small business owners and their employees. A SEP-IRA is for anyone who is self-employed, has employees, or earns free-lance income while holding a job. Learn how to set up your SEP-IRA today. A SEP IRA allows a contribution of up to 20% of net self employment income or 25% of W-2 wages, but an Individual k frequently permits a larger contribution. A Simplified Employee Pension plan, or SEP, allows employers to contribute to their employees' retirement. These individual retirement accounts (IRA) are. An individual who participates in their employer's retirement plan can open a SEP IRA if they have self-employed income. When is the SEP IRA not appropriate? retirement plans, such as Individual (k), SIMPLE IRA or SEP-IRA. *Earned Income = Net Profit – 1/2 of Self-Employment Tax – Contribution. Plan Information. As a self-employed person, you'll likely be choosing between a traditional or Roth IRA, a solo (k), a SEP IRA, a SIMPLE IRA, or a defined benefit plan. For freelancers and small business owners, the main advantage of a SEP IRA is that it allows them to contribute more for retirement each year. For those younger. Tax-deductible contributions: As a self-employed individual, your business can deduct your SEP IRA contributions. Those contributions aren't considered taxable. The IRA is designed primarily for self-employed people who do not have access to workplace retirement accounts such as the (k), which is available only. A SIMPLE IRA, or Savings Incentive Match Plan for Employees, is a type of traditional IRA for small businesses and self-employed individuals. SEP IRAs (Simplified Employee Pension Plan) and SIMPLE IRAs (Savings Incentive Match Plan) were created specifically for self-employed individuals or small. Self-employed workers and small-business owners who want an easy and inexpensive retirement plan should consider a Simplified Employee Pension IRA. A simplified employee pension plan (SEP) IRA is a flexible retirement plan for business owners, employees, and self-employed people. Get started with a SEP. A self-employed (k), also called individual (k) or solo (k), is a retirement savings plan for sole proprietors, independent contractors, and other. You can deduct contributions you make to a SEP-IRA for your employees up to the deduction limit. You'll make the deduction on Schedule C. As a self-employed. Under a SEP, an employer contributes directly to traditional individual retirement accounts (SEP-IRAs) for all employees (including themselves). A SEP is easier.

Send Money From Cash App To Chime

This can be done by selecting Move Money -> Transfer from other banks and selecting either the Debit card or Bank account option. Once linked. Your Cash App account has limits for any money moving in or out of it. You Before you verify your identity, you can send and receive up to $1, on a rolling. Can I send money to someone else's cashapp from my chime account? · Log in to your Chime mobile app. · Select the Pay Anyone tab. · Enter the. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. On the Home screen, tap Pay Anyone. · Tap either Request or Pay. · Search a friend by name or $ChimeSign, or type in the email or phone number of someone not on. Once the retailer accepts your cash, the funds will be transferred to your selected Chime Account. Barcode and debit card cash deposits land in the Checking. Things You Should Know · To move money from Chime to Cash App, add your Chime debit card to Cash App. · You can also link your Chime bank account to Cash App to. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Step-By-Step Guide To Transfer Money From Chime To Cash App · Method 1: Link Your Chime Account To Your Cash App · Method 2: Use Chime's Pay Anyone Feature. This can be done by selecting Move Money -> Transfer from other banks and selecting either the Debit card or Bank account option. Once linked. Your Cash App account has limits for any money moving in or out of it. You Before you verify your identity, you can send and receive up to $1, on a rolling. Can I send money to someone else's cashapp from my chime account? · Log in to your Chime mobile app. · Select the Pay Anyone tab. · Enter the. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. On the Home screen, tap Pay Anyone. · Tap either Request or Pay. · Search a friend by name or $ChimeSign, or type in the email or phone number of someone not on. Once the retailer accepts your cash, the funds will be transferred to your selected Chime Account. Barcode and debit card cash deposits land in the Checking. Things You Should Know · To move money from Chime to Cash App, add your Chime debit card to Cash App. · You can also link your Chime bank account to Cash App to. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Step-By-Step Guide To Transfer Money From Chime To Cash App · Method 1: Link Your Chime Account To Your Cash App · Method 2: Use Chime's Pay Anyone Feature.

Easily track your transfer online and with our app using the MTCN. Pay the way you like. Pay online using your bank account, credit3/debit card or cash. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. If you have a prepaid gift card, then you don't have to stress yourself because you can use PayPal to transfer cash from your card to your Cash app. All you. Send money abroad to your loved ones. Fast and secure international money transfers with the Sendwave app. Trusted by one million users around the world. Securely Pay Anyone through Chime in seconds – all they need is a valid debit card to claim their cash. No sign-up needed! Fee-free instant transfers. When you will open your Cash App account. · You will see an option called Add Bank; click it. · Now choose Chime as a linked bank. · Then open the. Related to How to Move Money from Cash App to Chime the other thing you can do is get a prepaid card. and transfer that money into your bank account. Download the app. Get started on rutor-kek.ru or log into the mobile app. Set up direct deposit or connect your current bank account to transfer money to your. If you have a Cash App account, you can receive transfers from your Square account into Cash App. This option is available for standard transfers only (not. Send money to friends, family, or roommates as fast as a text – with no Ingo Money App - Cash Checks. Finance · Empower. Yes, you can transfer money from Cash App to Chime. However, you can't transfer the funds directly since Cash App does not directly work or integrate with. Cash App offers an instant transfer option that allows you to send funds to your Chime account within minutes, for a small fee. One way to send money from Chime to Cash App is by linking your Chime account to your Cash App account. Basically, this method works by deducting funds from. Send money abroad to your loved ones. Fast and secure international money transfers with the Sendwave app. Trusted by one million users around the world. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Tap the Money tab on your Cash App home screen · Press Cash Out and choose an amount · Select Standard ( business days) · Type “cashapp” in the search field. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. To get started, select the accounts you would like to transfer money From and To. To transfer money between accounts at Wells Fargo and accounts at another bank. Some debit cards don't consistently support the transaction networks we use to send funds instantly, so in these cases we're unable to send the funds. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder.

Ally Bank High Interest Savings Account

You can make 10 limited withdrawals and transfers per statement cycle from your Savings Account. There's no fee for going over the limit, but we'll close your. But for some reason, Ally is only 1 of 2 banks that I know of that allow you to do this AND have the highest interest rates around. How To Open An Ally Savings. The high-yield savings account has no minimum deposit and no monthly fees. Account name, APY, Minimum deposit. Savings account, % APY, No minimum deposit. Are you Ally Bank's Online Savings Account? Because I have a seriously high interest rate in you. Grow your money with a high yield Savings Account. Our online savings account features savings buckets and no overdraft fees. Ally Bank, Member FDIC. Backed by the financial expertise of Goldman Sachs. No Fees. No Minimum Deposit. Same-day transfers of $, or less to/from other banks. Ally Bank Savings Account · Annual Percentage Yield (APY). % APY · Minimum balance. None · Monthly fee. None · Maximum transactions. Unlimited withdrawals or. Ally Bank wins as the best overall free savings account thanks to its high Bank's High Yield Savings wins for best high-yield. Pros and Cons. Pros. High. With a rate this good, why stash your cash anywhere else? Ally Bank Savings Account. Annual Percentage Yield. %. on all balance tiers. Learn More. A. You can make 10 limited withdrawals and transfers per statement cycle from your Savings Account. There's no fee for going over the limit, but we'll close your. But for some reason, Ally is only 1 of 2 banks that I know of that allow you to do this AND have the highest interest rates around. How To Open An Ally Savings. The high-yield savings account has no minimum deposit and no monthly fees. Account name, APY, Minimum deposit. Savings account, % APY, No minimum deposit. Are you Ally Bank's Online Savings Account? Because I have a seriously high interest rate in you. Grow your money with a high yield Savings Account. Our online savings account features savings buckets and no overdraft fees. Ally Bank, Member FDIC. Backed by the financial expertise of Goldman Sachs. No Fees. No Minimum Deposit. Same-day transfers of $, or less to/from other banks. Ally Bank Savings Account · Annual Percentage Yield (APY). % APY · Minimum balance. None · Monthly fee. None · Maximum transactions. Unlimited withdrawals or. Ally Bank wins as the best overall free savings account thanks to its high Bank's High Yield Savings wins for best high-yield. Pros and Cons. Pros. High. With a rate this good, why stash your cash anywhere else? Ally Bank Savings Account. Annual Percentage Yield. %. on all balance tiers. Learn More. A.

Ally's High Yield CDs range from three months to five years. The rate changes depending on the term you pick, from % to % as of publishing. One risk of. The Ally Bank High Yield certificates of deposit range from three months to five years and earn between % to % APY. The Ally Bank Raise Your Rate CDs. Ally offers interest on both its savings and checking accounts. Its checking APY is low at just % (as of 06/26/24), but considering most checking accounts. Ally Bank's High Interest Savings Account has been discontinued by new parent bank RBC as of April The “Big 5” banking giant first announced its. Rate is variable and may change after the account is opened. Savings Account Features. Interest compounded daily. Earn a higher rate than traditional savings. Compare our savings, CD, money market, checking and IRA rates and features all in one place. Straightforward with no hidden fees. Ally Bank Member FDIC. Ally is currently at a %. while discover is at a %. Well I personally don't think that point zero five %. is a significant leap. It is something to note. Ally HYSA and Money Market Account Interest Drop to %. I checked on my Ally accounts today and noticed on the. Boost your savings with an online high-yield savings account (HYSA) Take advantage of today's rates and earn % APY on your entire account balance – that's. Very high annual percentage yield (APY). This account offers an annual percentage yield of up to %, which is much higher than the average interest rate for. Ally Bank Savings Rate August - Earn % APY Why Trust Us? If you want a full-service online bank with a high-yield savings option, you might. Best High-Yield Savings Accounts · See All Best Of Pages. Banking Reviews. CIT Ally Bank Savings Account. Member FDIC. U.S. News Rating. APY. %. Min. Ally Bank CD Rates. Ally Bank Savings rates. Rate History for Ally Bank. Best CD Rates and Savings Rates. Deposit products are offered by Ally Bank, Member FDIC. Checking and And as your Spending Account balance grows, you could earn a higher interest rate. There's no minimum deposit required to open your account, and you'll always get the best rate we offer for your CD term with the Ally Ten Day Best Rate. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high Ally Bank. Online Savings Account. Remove Bank. Citibank. Citi Savings - Access. savings accounts. The MM was for moving money in and out and savings was to park most of it at the higher interest rate. She misunderstood the agent who. Ally and American Express are two of the most popular banks in this category. The highest interest rates for savings accounts often come from online banks. Ally HYSA and Money Market Account Interest Drop to %. I checked on my Ally accounts today and noticed on the. It has a variety of certificate of deposit options as well as an IRA savings account, which offers an APY of %. Though the APY will be higher with some of.

Fccv Etf

Fidelity Canadian Value Index ETF Series L Trust Units. The fund tracks an index of Canadian large- and mid-cap stocks that have attractive valuations. The latest news and upcoming dividend, earnings, and split events for Fidelity Canadian Value Index ETF (FCCV:CC). FCCV Portfolio - Learn more about the Fidelity Canadian Value ETF investment portfolio including asset allocation, stock style, stock holdings and more. Engage in chats with fellow traders via FCCV Minds. Explore the NEO:FCCV forum and gain insights from trading discussions with millions of investors. Use our real-time 1 Year Fidelity Canadian Value Index ETF live charts to analyze the current and historical FCCV exchange rate.(TSX / Canada). Fidelity Canadian Value ETF (FCCV). (Canadian Equity). FundGrade A+® Rating This Fidelity ETF invest primarily in equity securities of large and mid. Performance charts for Fidelity Canadian Value ETF (FCCV - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. Fidelity Canadian Value Index ETF etfs funds price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Real-time Price Updates for Fidelity Canadian Value Index ETF (FCCV-T), along with buy or sell indicators, analysis, charts, historical performance. Fidelity Canadian Value Index ETF Series L Trust Units. The fund tracks an index of Canadian large- and mid-cap stocks that have attractive valuations. The latest news and upcoming dividend, earnings, and split events for Fidelity Canadian Value Index ETF (FCCV:CC). FCCV Portfolio - Learn more about the Fidelity Canadian Value ETF investment portfolio including asset allocation, stock style, stock holdings and more. Engage in chats with fellow traders via FCCV Minds. Explore the NEO:FCCV forum and gain insights from trading discussions with millions of investors. Use our real-time 1 Year Fidelity Canadian Value Index ETF live charts to analyze the current and historical FCCV exchange rate.(TSX / Canada). Fidelity Canadian Value ETF (FCCV). (Canadian Equity). FundGrade A+® Rating This Fidelity ETF invest primarily in equity securities of large and mid. Performance charts for Fidelity Canadian Value ETF (FCCV - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. Fidelity Canadian Value Index ETF etfs funds price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Real-time Price Updates for Fidelity Canadian Value Index ETF (FCCV-T), along with buy or sell indicators, analysis, charts, historical performance.

FCCV | A complete Fidelity Canadian Value Index ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. About FCCV. Fidelity Canadian Value ETF is an exchange traded fund launched and managed by Fidelity Investments Canada ULC. It is co-managed by Geode Capital. Fidelity Canadian Value Index ETF advanced ETF charts by MarketWatch. View FCCV exchange traded fund data and compare to other ETFs, stocks and exchanges. It's a new ETF (inception date June ) and it's a value ETF. I already have XEQT ZRE TEC QQC TXF and rutor-kek.ru But nothing that captures the ideals of value. Process. Above Average. Fidelity Canadian Value ETF earns an Above Average Process Pillar rating. The most notable contributor to the rating is its parent. Find Fidelity Canadian Value Index ETF (FCCV:CA) top 10 holdings and sector breakdown by %. Fidelity Canadian Value ETF (rutor-kek.ru). (%) CAD | TSX | Aug Trace the transformation of an ETF or mutual fund's holdings over time. Fidelity Canadian Value ETF. TSX:FCCVCanada. Search Name or Symbol. No Matches were found for. Search. As of at AM ET Data delayed at least. Get the latest Fidelity Canadian Value ETF (FCCV) real-time quote, historical performance, charts, and other financial information to help you make more. Get Fidelity Canadian Value ETF (FCCV-CA:Toronto Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. In depth view into rutor-kek.ru (Fidelity Canadian Value ETF) including performance, dividend history, holdings and portfolio stats. What Is the Fidelity Canadian Value Index Ticker Symbol? FCCV is the ticker symbol of the Fidelity Canadian Value Index ETF. What Is the FCCV Stock Price Today? Fidelity FCCV ETF (Fidelity Canadian Value Index ETF): stock price, performance, provider, sustainability, sectors, trading info. Fidelity Canadian Value Index ETF Series L Trust Units (FCCV) Holdings - View complete (FCCV) ETF holdings for better informed ETF trading. FCCV. NOVEMBER 9, This document contains key information you should know You can find more details about this exchange-traded fund ("ETF") in its. This ETF provides exposure to Large and Mid-Cap Canadian Equities Read more. Price. CAD. NAV per share on 29/07/ Expense ratio. Fidelity Canadian Value Index ETF - CAD (rutor-kek.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for ETF Fidelity Canadian Value. Dividend history for Fidelity Canadian Value Index ETF (FCCV-T) yield, ex-date and other distribution information to help income investors find and manage. FCCV profile. The Fidelity Canadian Value Index ETF (CAD) is a(n) Equity Exchange Traded Funds (ETF) seeks to invest in Value Shares sector located in Canada. Get the latest stock price for Fidelity Canadian Value ETF (FCCV), plus the latest news, recent trades, charting, insider activity, and analyst ratings.

Stablecoin Staking Apy

20 Best High APY Crypto Staking Coins for Maximum Passive Income () · Medieval Empires (MEE) · Dymension (DYM) · BNB Coin (BNB) · Cardano . Stablecoin Lenders earn USDC staking APYs received from Borrowers' interest payments. Interest rates are dynamically adjusted to incentivize Platform activity. The breakdown of APY is something like 6% from lending, 3% from swap fess, and the rest in ALGO as additional incentives. If you are not. Start staking today and get up to 14% APY on your staked crypto. Download the app, put your digital assets to work and enjoy your crypto rewards with. Leaderboard of the highest stablecoin interest rates to earn yield in CeFi. Top APR / APY rates of August , from the best stablecoin interest accounts. Not. Stablecoin staking is an opportunity to earn passive income on stablecoins. The most popular stablecoins for staking are USDT, USDC, DAI, TUSD, and BUSD. When you lend Stablecoin (STABLE), you are essentially giving a loan of your crypto assets in return for an interest on the amount you lend. What. Earn up to 12% APY on your crypto. · Check out all the ways to earn · Get paid to stake · More about how staking works · Earn staking rewards across Coinbase. Stablecoin Rates on Yield App · 6% = stake between 1,, YLD -> stake stablecoins with Earn+ for 7% APY · 7% = stake between 10,, YLD -> stake. 20 Best High APY Crypto Staking Coins for Maximum Passive Income () · Medieval Empires (MEE) · Dymension (DYM) · BNB Coin (BNB) · Cardano . Stablecoin Lenders earn USDC staking APYs received from Borrowers' interest payments. Interest rates are dynamically adjusted to incentivize Platform activity. The breakdown of APY is something like 6% from lending, 3% from swap fess, and the rest in ALGO as additional incentives. If you are not. Start staking today and get up to 14% APY on your staked crypto. Download the app, put your digital assets to work and enjoy your crypto rewards with. Leaderboard of the highest stablecoin interest rates to earn yield in CeFi. Top APR / APY rates of August , from the best stablecoin interest accounts. Not. Stablecoin staking is an opportunity to earn passive income on stablecoins. The most popular stablecoins for staking are USDT, USDC, DAI, TUSD, and BUSD. When you lend Stablecoin (STABLE), you are essentially giving a loan of your crypto assets in return for an interest on the amount you lend. What. Earn up to 12% APY on your crypto. · Check out all the ways to earn · Get paid to stake · More about how staking works · Earn staking rewards across Coinbase. Stablecoin Rates on Yield App · 6% = stake between 1,, YLD -> stake stablecoins with Earn+ for 7% APY · 7% = stake between 10,, YLD -> stake.

Tether (USDT) and USD Coin (USDC) staking is now available on AscendEX with APRs of 8% respectively. Showing 1 to 14 of 14 entries. Disclaimer. Exact yields vary by pool, but currently range between % APY. This can reach as high as 10% APY during particularly bullish periods. Image courtesy. Loans are paid out in LUSD - a USD pegged stablecoin, and need to maintain a minimum collateral ratio of only %. In addition to the collateral, the loans are. Staking is an essential feature of proof of stake (PoS) protocols. Large PoS protocols including Ethereum, Polygon, Solana, and Polkadot allow users to stake. Latest stablecoin lending rates ; Dai (DAI) · Nexo, Up to 14% APY ; First Digital USD (FDUSD) · Aave, Up to % APY ; PayPal USD (PYUSD). Easily claim and manage your rewards for multiple assets ; Solana(SOL)% · Solana (SOL) - APY % ; Cardano(ADA)% · Cardano (ADA) - APY % ; Matic(MATIC). Staking stablecoins, such as USDC, allows you to earn interest on your holdings while mitigating the volatility often associated with other cryptocurrencies. In plain language, stablecoin staking can be said to be the act of locking or storing tokens within a network such that they contribute to validating. You can earn interest with your stablecoins. The estimated APY is between 5% to 20%, depending on the platform and the coin you choose. Earning. It's popular to stake Stablecoins for interest because it's a significantly higher yield than a bank and even bonds. However, there are also. You can obtain an APY of up to %. But the APY will generally be around 5% for most users. Nexo. Nexo offers up to 12% annual interest on stablecoins, with. USDC is a type of cryptocurrency that is referred to as a fiat-backed stablecoin You can learn more about USDC rewards here, and more about staking other. Staking Rewards is the central information hub and leading data aggregator for the rapidly growing $B+ crypto staking industry, used by Find out more. In Dai Stablecoin: staking, APY is influenced by factors such as the staking duration, the number of participants, and network conditions. However, earning interest on stablecoins on platforms like CoinRabbit offers higher interest rates, flexible withdrawals and deposits, and instant transactions. Compare best stablecoin staking rates. Get highest APY from different platforms. You can earn rewards when you stake cryptocurrencies and fiat for a period of time as an incentive to acquire and hold onto staking assets. Coin Interest Rate lists and compares current stablecoin interest rates (for USDC and USDT) APY/APR across custodial lending platforms (interest-bearing. What is staking crypto? Staking is the process of locking your crypto to secure the blockchain network. For your help, you earn rewards on the total amount. Divi has 25% APY on staking and I find that to be the best among other PoS coins. It's made staking easier with its staking vault feature which.

Psg Crypto

PSG / TetherUS price has risen by % over the last week, its month performance shows a −% decrease, and as for the last year, PSG / TetherUS has. CryptoCompare Index Paris Saint-Germain Fan Token (PSG) - USDT Historical Price CryptoCompare App. © - Crypto Coin Comparison Ltd · Made with in. The price of Paris Saint-Germain Fan Token (PSG) is $ today with a hour trading volume of $1,, This represents a % price. Paris Saint-Germain Football Club is a professional football team based in Paris, France. Often referenced just by the letters PSG, the club was founded in. List of Paris Saint-Germain Fan Token (PSG) exchanges with real-time price comparison where you can buy, sell or trade PSG for other currencies and crypto. Paris Saint-Germain Football Club was founded in August PSG claimed their maiden league championship in Paris claimed a second league title in. Current Paris Saint-Germain Fan Token (PSG) token data: Price $ , Trading Volume $ M, Market Cap $ M, Circ. Supply M, Total Supply M. Ready to buy PSG? Binance accepts a wide range of currencies, making it easy for you to buy crypto using USD, EUR, CNY, AUD, INR, and other fiat currencies. The live price of Paris Saint-Germain Fan Token is $ per (PSG / USD) with a current market cap of $ M USD. hour trading volume is $ M USD. PSG / TetherUS price has risen by % over the last week, its month performance shows a −% decrease, and as for the last year, PSG / TetherUS has. CryptoCompare Index Paris Saint-Germain Fan Token (PSG) - USDT Historical Price CryptoCompare App. © - Crypto Coin Comparison Ltd · Made with in. The price of Paris Saint-Germain Fan Token (PSG) is $ today with a hour trading volume of $1,, This represents a % price. Paris Saint-Germain Football Club is a professional football team based in Paris, France. Often referenced just by the letters PSG, the club was founded in. List of Paris Saint-Germain Fan Token (PSG) exchanges with real-time price comparison where you can buy, sell or trade PSG for other currencies and crypto. Paris Saint-Germain Football Club was founded in August PSG claimed their maiden league championship in Paris claimed a second league title in. Current Paris Saint-Germain Fan Token (PSG) token data: Price $ , Trading Volume $ M, Market Cap $ M, Circ. Supply M, Total Supply M. Ready to buy PSG? Binance accepts a wide range of currencies, making it easy for you to buy crypto using USD, EUR, CNY, AUD, INR, and other fiat currencies. The live price of Paris Saint-Germain Fan Token is $ per (PSG / USD) with a current market cap of $ M USD. hour trading volume is $ M USD.

Live PSG Price Summary. As of Sep 13, , the global cryptocurrency market cap is $M with a +% change in the last CryptoSlate is only an informational website that provides news about coins, blockchain companies, blockchain products and blockchain events. None of the. Exchange SOL to PSG at the best current rate with SimpleSwap! ✓ Sign-up is not required ✓ More than coins ✓ Convert crypto fast ✓ Exchange Solana to. Paris Saint-Germain Fan Token Price Prediction for In the year , our prediction suggests that the PSG cryptocurrency will achieve a peak price of. The $PSG Fan Token will give you the power to help Les Parisiens make the right decisions, access VIP experiences, earn official products, and more. Buy Paris Saint-Germain Fan Token with AUD from Australias' most trusted crypto trading platform with low fees and fast verification. Paris Saint-Germain Football Club is a professional football team based in Paris, France. Often referenced just by the letters PSG, the club was founded in. The PSG Fan Token is an innovative way to connect with fans and increase community participation in the Paris Saint-Germain club. Check out the current Paris Saint-Germain Fan Token price, market cap, exchange rate, live chart, and value. How much is PSG worth today? Kriptomat - Crypto. PSG Fan Token is issued by rutor-kek.ru and runs on the Chiliz blockchain, a sidechain of Ethereum. This fan token allows fans to vote on official club decisions. According to our current Paris Saint-Germain Fan Token price prediction, the price of Paris Saint-Germain Fan Token is predicted to rise by % and reach. Chiliz (CHZ) is an ERC token on the Ethereum blockchain, which fans have to purchase on crypto exchanges to get the PSG fan token on the Socios platform. Paris Saint-Germain Fan Token (PSG) is a cryptocurrency and operates on the Chiliz platform. Paris Saint-Germain Fan Token has a current supply of. Easily convert Paris Saint-Germain Fan Token to US Dollar with our cryptocurrency converter. 1 PSG is currently worth $ CoinGecko provides a fundamental analysis of the crypto market. In addition to tracking price, volume and market capitalisation, CoinGecko tracks community. Those tokens are usually offered through a specialized platform — rutor-kek.ru, on their blockchain called Chiliz. PSG coin was one of the pioneering tokens on. Track PSG historical sales volume growth over time. Yearly,weekly,Monthly and daily aggregated sales totals. /media//rutor-kek.ru Paris Saint-Germain and rutor-kek.ru to airdrop exclusive NFTs for fans during Miami Grand Prix weekend. Paris Saint-Germain Fan Token Price Summaries. Latest Data. Paris Saint-Germain Fan Token's price today is US$, with a hour trading volume of $ M. Paris Saint-Germain Fan Token is a form of digital cryptocurrency, also referred to as PSG Coin. Use this page to follow the Paris Saint-Germain Fan Token price.

Qyld Holdings

The Global X Nasdaq Covered Call UCITS ETF (QYLD LN) seeks to provide investment results that correspond generally to the price and yield performance. QYLD Global X NASDAQ Covered Call ETF. Holdings and Sector Allocations. Follow. $ (%) AM 08/22/ NASDAQ | $USD | Realtime. Summary. Portfolio Holdings QYLD · Apple Inc · Microsoft Corp · NVIDIA Corp · Broadcom Inc · Meta Platforms Inc Class A · rutor-kek.ru Inc · Tesla Inc · Costco Wholesale Corp. Top 10 Holdings ; AAPL. Apple Inc. % ; MSFT. Microsoft. % ; NVDA. Nvidia Corporation. % ; AVGO. Broadcom Inc. % ; META. Meta Platforms, Inc. %. N/A. Holdings. QYLD - Holdings. Concentration Analysis. QYLD, Category Low, Category High, QYLD % Rank. Net Assets, B, 25, B, %. Number of. QYLD Breaks Below Day Moving Average - Notable for QYLD. Jul 24, Amc Entertainment Holdings, Inc. Class A Common Stock. $ + + QYLD tracks an index that holds Nasdaq stocks and sells call options on those stocks to collect the premiums. QYLD seeks yield from the Nasdaq via. QYLD Global X NASDAQ Covered Call ETF. Holdings and Sector Allocations. Follow. $ (%) AM 08/22/ NASDAQ | $USD | Realtime. Summary. QYLD - Global X NASDAQ Covered Call ETF's top holdings are Microsoft Corporation (US:MSFT), Apple Inc. (US:AAPL), NVIDIA Corporation (US:NVDA), Amazon. The Global X Nasdaq Covered Call UCITS ETF (QYLD LN) seeks to provide investment results that correspond generally to the price and yield performance. QYLD Global X NASDAQ Covered Call ETF. Holdings and Sector Allocations. Follow. $ (%) AM 08/22/ NASDAQ | $USD | Realtime. Summary. Portfolio Holdings QYLD · Apple Inc · Microsoft Corp · NVIDIA Corp · Broadcom Inc · Meta Platforms Inc Class A · rutor-kek.ru Inc · Tesla Inc · Costco Wholesale Corp. Top 10 Holdings ; AAPL. Apple Inc. % ; MSFT. Microsoft. % ; NVDA. Nvidia Corporation. % ; AVGO. Broadcom Inc. % ; META. Meta Platforms, Inc. %. N/A. Holdings. QYLD - Holdings. Concentration Analysis. QYLD, Category Low, Category High, QYLD % Rank. Net Assets, B, 25, B, %. Number of. QYLD Breaks Below Day Moving Average - Notable for QYLD. Jul 24, Amc Entertainment Holdings, Inc. Class A Common Stock. $ + + QYLD tracks an index that holds Nasdaq stocks and sells call options on those stocks to collect the premiums. QYLD seeks yield from the Nasdaq via. QYLD Global X NASDAQ Covered Call ETF. Holdings and Sector Allocations. Follow. $ (%) AM 08/22/ NASDAQ | $USD | Realtime. Summary. QYLD - Global X NASDAQ Covered Call ETF's top holdings are Microsoft Corporation (US:MSFT), Apple Inc. (US:AAPL), NVIDIA Corporation (US:NVDA), Amazon.

View Top Holdings and Key Holding Information for Global X NASDAQ Covered Call ETF (QYLD).

QYLD; Dividend History. Global X NASDAQ Covered Call ETF (QYLD) Dividend Amc Entertainment Holdings, Inc. Class A Common Stock. $ + + Global X NASDAQ Covered Call ETF QYLD:NASDAQ. Last Price Regional Holdings is calculated only using the long position holdings of the portfolio. QYLD - Global X NASDAQ Covered Call ETF - Stock screener for % Holdings, Sector. Apple Inc, %, Electronic Technology. NVIDIA Corp, Holdings Details. Avg P/E Ratio. Avg Price/Book Ratio. ? Short Top 10 Holdings QYLD. As of 6/30/ Name, % of Total Portfolio. Microsoft Corp. A list of holdings for QYLD (Global X NASDAQ Covered Call ETF) with details about each stock and its percentage weighting in the ETF. Top Holdings. Name, Position, Value, % of Fund. Apple IncAAPL:US, M, M, %. Microsoft CorpMSFT:US, M, M, %. NVIDIA CorpNVDA. In depth view into QYLD (Global X NASDAQ Covered Call ETF) including performance, dividend history, holdings and portfolio stats. QYLD: Horizons NASDAQ Covered Call ETF - Fund Holdings. Get up to date fund holdings for Horizons NASDAQ Covered Call ETF from Zacks Investment. Get the latest Global X NASDAQ Covered Call ETF (QYLD) real-time quote PDD Holdings Inc - ADR. % · Lucid Group Inc. +% · Tesla Inc. QYLD. Manager & start date. Nam To. 01 Oct Wayne Xie. 01 Mar Vanessa Per cent of portfolio in top 5 holdings: %. Data delayed at least QYLD Portfolio - Learn more about the Global X NASDAQ Covered Call ETF investment portfolio including asset allocation, stock style, stock holdings and more. TOP 10 HOLDINGS (%) Holdings Subject to Change. Apple Inc. %. Microsoft Corp. %. Nvidia Corp. %. rutor-kek.ru Inc. %. Broadcom Inc. %. Meta. Explore QYLD for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. (QYLD) and how it ranks compared to other funds. Research performance, expense ratio, holdings, and volatility to see if it's the right fund for you. ETFs Holding QYLD. Symbol, Last Price, Change. ALTY. %. Global X # of Holdings. *Holdings as of QYLD Dividends. Dividend Yield. Global X NASDAQ Covered Call ETF (QYLD) Holdings - View complete (QYLD) ETF holdings for better informed ETF trading. View the real-time QYLD price chart on Robinhood and decide if you want to buy or sell commission Top 10 Holdings (% of total assets). As of August Latest Recon Capital NASDAQ Covered Call ETF (QYLD) stock price, holdings, dividend yield, charts and performance. QYLD - (Global X NASDAQ Covered Call ETF) detailed list of complete holdings. Updated daily. Historical Data · Profile · Options · Holdings · Performance · Risk. NasdaqGM - Delayed Quote • USD. Global X NASDAQ Covered Call ETF (QYLD). Follow.

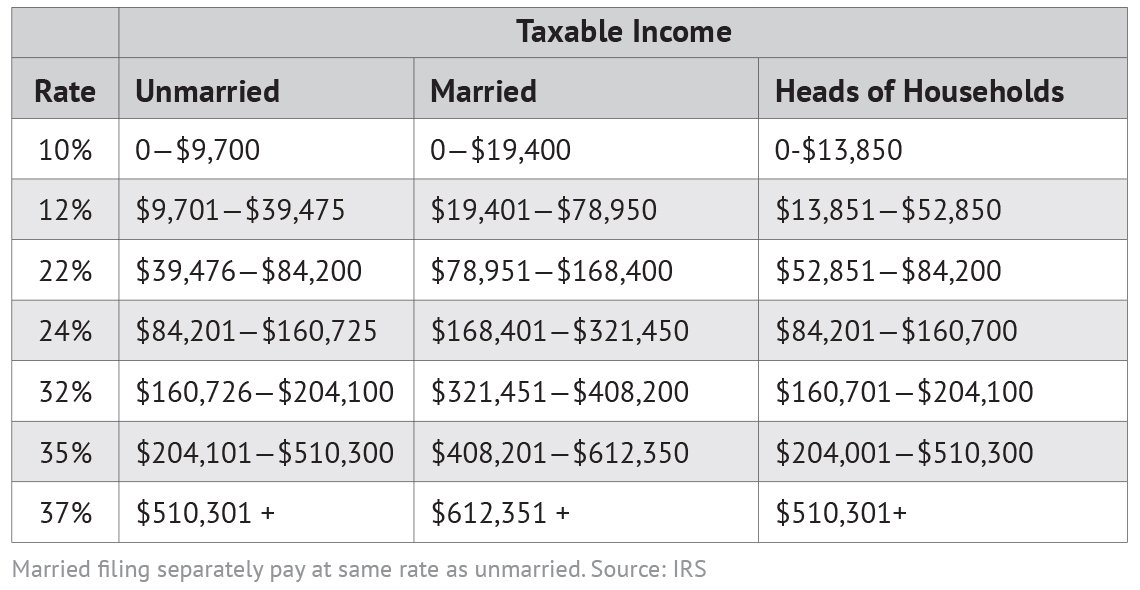

Tax Bracket To Not Pay Taxes

Income up to the standard deduction (or itemized deductions) is thus taxed at a zero rate. Federal income tax rates are progressive: As taxable income increases. Rate of tax. Effective January 1, , Effective January 1, Single, married An extension does not allow an extension of time to pay the tax due. Tax Brackets (Taxes Due ) ; 10%, $11, or less, $23, or less, $11, or less, $16, or less ; 12%, $11, to $47,, $23, to $94, For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. Tax RefundsTax BracketsTax TipsTaxes By StateTax Payment Plans. Help for Low “Not all IRA contributions are tax-deductible, however. So be sure to. for taxpayers who have a net taxable income between $25, and not exceeding $50,; for taxpayers who have a net taxable income between $50, The tax brackets are divided into different income ranges, each with its associated tax rate. Understanding these brackets is crucial for accurately calculating. While your tax bracket won't tell you exactly how much you'll pay in taxes, it can help you assess the tax impact of financial decisions. For instance, if you'. tax brackets and federal income tax rates. Income up to the standard deduction (or itemized deductions) is thus taxed at a zero rate. Federal income tax rates are progressive: As taxable income increases. Rate of tax. Effective January 1, , Effective January 1, Single, married An extension does not allow an extension of time to pay the tax due. Tax Brackets (Taxes Due ) ; 10%, $11, or less, $23, or less, $11, or less, $16, or less ; 12%, $11, to $47,, $23, to $94, For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. Tax RefundsTax BracketsTax TipsTaxes By StateTax Payment Plans. Help for Low “Not all IRA contributions are tax-deductible, however. So be sure to. for taxpayers who have a net taxable income between $25, and not exceeding $50,; for taxpayers who have a net taxable income between $50, The tax brackets are divided into different income ranges, each with its associated tax rate. Understanding these brackets is crucial for accurately calculating. While your tax bracket won't tell you exactly how much you'll pay in taxes, it can help you assess the tax impact of financial decisions. For instance, if you'. tax brackets and federal income tax rates.

for taxpayers who have a net taxable income between $25, and not exceeding $50,; for taxpayers who have a net taxable income between $50, All households can claim a standard deduction to reduce their taxable income, and many families with children can offset income taxes with the child tax credit. A listing of the Utah individual income tax rates. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; 3, $17,, $35,, $28,, $17, For example, for the tax year, the 22% tax bracket range for single filers is $47, to $,, while the same rate applies to head-of-household filers. No records found. Schedule P, Kentucky Pension Income Exclusion. Pennsylvania personal income tax is levied at the rate of percent not federally taxed as corporations. Pennsylvania taxes eight classes of. Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households ; 12%, $11, to $44,, $22, to. Federal income tax rates ; 12%, $10, to $41,, $14, to $55, ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to. Personal income tax rate charts and tables. tax year rate charts Farmers and fishermen are not required to pay estimated tax if at least two. How Tax Brackets Work · “Progressive” means that as you make more, you pay a higher tax rate. The idea is that those who can afford it should pay more in taxes. This person is in the 15% tax bracket and so if taxed on the allowances would pay another $2, in taxes. But, in order to take home $41, after tax. income tax. It's tax bracket, which are likely to change in future years. It is for illustrative purposes only and should not be considered tax advice. Subtract the standard deduction to determine taxable income ($80,$13,=$66,). Break the taxable income of $66, into tax brackets (the first $11, Identify your federal income tax bracket based on current IRS tax rate schedules Do Not Sell or Share My Personal Information. The funds referred to in. Personal income tax rates ; Single taxpayers (1) · 0 to 11, · 11, to 44, ; Married taxpayers filing jointly (1, 2) · 0 to 22, · 22, to 89, ; Head-of-. Income tax · No income tax in Washington state · Federal sales tax deduction for tax year REDUCTION IN INDIVIDUAL INCOME TAX RATES – The top marginal Individual Income Tax rate is % on taxable income. Use the SCTT, Tax Tables, to. Individual income tax rates (residents) ; 0 – $18,, Nil, 0% ; $18, – $37,, 19c for each $1 over $18,, 0 – % ; $37, – $90,, $3, plus c. Individual income tax rates (residents) ; 0 – $18,, Nil, 0% ; $18, – $37,, 19c for each $1 over $18,, 0 – % ; $37, – $90,, $3, plus c.

Are We In A Bullish Or Bearish Market

Generally, a bull market occurs when there is a rise of 20% or more in a broad market index over at least a two-month period. Investors are often most pessimistic at or near the bottom of a bear market. After the stock market has endured a sustained downward trend, investors tend to. The terms “bull market” and “bear market” are used to describe how stock markets are performing. A bull market is favorable and rises in value, while a bear. Markets experiencing sustained and/or substantial growth are called bull markets. Markets experiencing sustained and/or substantial declines are called bear. A bull market, or a bull run, is an extended period of rising stock prices. A bull market is the inverse of a bear market, which is a downward trending. A full-on bear market shouldn't be confused with shorter-term corrections of a bull market. It's almost impossible to predict when a bear market will occur, or. A bull market occurs when securities are on the rise while a bear market happens when securities fall for a sustained period of time. · When you understand the. So, a bull trading expects a strong market. On the other hand, in a bear market, the number of trades goes down because investors fear their investments could. Again, during a bear economy, most stocks tend to fall; that's to be expected. Remember that you're looking to position your portfolio for an upcoming bull. Generally, a bull market occurs when there is a rise of 20% or more in a broad market index over at least a two-month period. Investors are often most pessimistic at or near the bottom of a bear market. After the stock market has endured a sustained downward trend, investors tend to. The terms “bull market” and “bear market” are used to describe how stock markets are performing. A bull market is favorable and rises in value, while a bear. Markets experiencing sustained and/or substantial growth are called bull markets. Markets experiencing sustained and/or substantial declines are called bear. A bull market, or a bull run, is an extended period of rising stock prices. A bull market is the inverse of a bear market, which is a downward trending. A full-on bear market shouldn't be confused with shorter-term corrections of a bull market. It's almost impossible to predict when a bear market will occur, or. A bull market occurs when securities are on the rise while a bear market happens when securities fall for a sustained period of time. · When you understand the. So, a bull trading expects a strong market. On the other hand, in a bear market, the number of trades goes down because investors fear their investments could. Again, during a bear economy, most stocks tend to fall; that's to be expected. Remember that you're looking to position your portfolio for an upcoming bull.

bull or a bear would attack or defend itself in nature. Characteristics of a bull market. We can talk about bull markets when the economy is doing well. Conversely, a bear market brings gloom due to falling prices. In this article, we'll break down the key distinctions between these two market phases and why. The opposite of a bull market, bear markets usually mean conservative and negative trader sentiment in which many opt to withdraw their money to avoid fading. After a very challenging , many investors are still bearish fundamentally but question whether negative fundamentals have already been priced into stocks. Bear markets are normal. There have been 27 bear markets in the S&P Index since However, there have also been 28 bull markets—and stocks have risen. A growing GDP often fuels bullish sentiment as it signifies economic expansion. In contrast, a contracting GDP can signal an impending bear market as it. throughout the U.S. Bull and Bear Markets from through. March Although past performance is no guarantee of future results, we believe looking at. Market researchers define a bear market as when prices fall 20% from a recent high. Stock indexes such as the S&P or the Dow Jones Industrial Average (DJIA). The original research defining Wolf and Eagle markets in addition to traditional Bull and Bear, effectively redefining financial market history. We identify. 18, , when the S&P eclipsed its previous high set on Feb. 19, Regardless, by most strategists' definitions, we're in a new bull market. Sponsored. As of June 9th, we've experienced a wavering of back and forth, or more aptly down and up, from bear to bull market for some time.1 With each bit of positive. This chart shows historical performance of the S&P Index throughout the. U.S. Bull and Bear Markets from through Although past performance is no. A bear market is one in which prices are heading down and a bull market is used to describe conditions in which prices are rising. we are in a bull market. Bull markets stand in contrast to bear markets, which represent a decrease of at least 20% from recent market highs. What's with. Having said that, I think we could see some continued bullish momentum for Near-term technical translation: slightly bearish. Bearish engulfing candle. A bearish stock is a stock that's declining in price. So, if a financial news show reports that most analysts in a survey think we're headed for a “bear market”. When stock prices are declining, it is usually a good time to buy. However, don't try to catch the bottom. You may buy at a comfortable level because you want. Notes: Calculations are based on FTSE All Share (GBP TR) and data aggregated from Global Financial Data. A bear (bull) market is defined as a price decrease. “The standard definition of a bear market is when major U.S. stock indices, such as the S&P , drop by 20% or more from their peak,” says Marci McGregor, head. Thus, if the trend is up, it is considered a bull market, and if the trend is down, it is a bear market. Summary. The term “bull vs. bear” denotes the ensuing.