rutor-kek.ru

Overview

Is A 1 Interest Rate Drop Worth Refinancing

The best part? As rates dip further, more homeowners will stand to benefit from refinancing. The number could soon hit a million if mortgage rates fall as. only one-fourth of cash-outs and payoffs of existing debt resulted in an average interest rate reduction comparable to the change in payments savings, then the. General rule of thumb is to refinance if your new rate is at least 1% lower. May not be worth it until you have enough equity/LTV is at a good. 7/1 Arm Mortgage Rates · 5/1 Arm Mortgage Rates · 3/1 Arm Mortgage Rates So there's a chance you could see a big drop in your interest rate by refinancing. If mortgage rates have shifted since you bought your home, you may be thinking about refinancing. Use this calculator to find out if you could save on. Save Money—If a borrower negotiated a loan during a period of high interest rates, and interest rates have since decreased, it may be possible to refinance to a. How To Get the Lowest Refinance Rate · 1. Raise Your Credit Score · 2. Shop Around for the Best Rate · 3. Keep Your Loan-to-Value Ratio Low. When you need cash to pay for home improvements or repairs that might increase the value of your home, it may make sense to accept a higher rate. Getting money. One point equals one percent of the loan amount All mortgage interest rate reduction offers may be subject to a maximum interest rate reduction limit. The best part? As rates dip further, more homeowners will stand to benefit from refinancing. The number could soon hit a million if mortgage rates fall as. only one-fourth of cash-outs and payoffs of existing debt resulted in an average interest rate reduction comparable to the change in payments savings, then the. General rule of thumb is to refinance if your new rate is at least 1% lower. May not be worth it until you have enough equity/LTV is at a good. 7/1 Arm Mortgage Rates · 5/1 Arm Mortgage Rates · 3/1 Arm Mortgage Rates So there's a chance you could see a big drop in your interest rate by refinancing. If mortgage rates have shifted since you bought your home, you may be thinking about refinancing. Use this calculator to find out if you could save on. Save Money—If a borrower negotiated a loan during a period of high interest rates, and interest rates have since decreased, it may be possible to refinance to a. How To Get the Lowest Refinance Rate · 1. Raise Your Credit Score · 2. Shop Around for the Best Rate · 3. Keep Your Loan-to-Value Ratio Low. When you need cash to pay for home improvements or repairs that might increase the value of your home, it may make sense to accept a higher rate. Getting money. One point equals one percent of the loan amount All mortgage interest rate reduction offers may be subject to a maximum interest rate reduction limit.

Usually refinancing starts making sense at or around 1 percentage point reduction in rate. As the Fed usually move at a fourth of a percentage. The first is that you should only consider refinancing if the new interest rate is at least 1 point lower than your current interest rate. You'll be paying. If you can drop your interest rate at least 1 percentage point, refinancing is worth considering. Your credit score has improved since you got your mortgage. One of the most popular reasons for refinancing, lowering your interest rate by even a percentage or two can save money, reduce your monthly house payments and. Even a slight reduction in the interest rate can lower your monthly payments. Consolidate your debt. Thanks to lower interest rates, refinancing can free up. "In return, you will generally pay a higher interest rate." No-closing-cost refinancing could be an advantage if you need to refinance but don't have a lot of. Other times, homeowners want to refinance in order to change the term of their current mortgage from a year term to 15 years. Depending on the interest rate. One of the most popular reasons for refinancing, lowering your interest rate by even a percentage or two can save money, reduce your monthly house payments and. Historically, many mortgage experts have said that a good time to refinance is when market rates dip 1% below the interest rate you currently pay. Of course, if. Current mortgage refinance news. The amount of refinances hit a year low in Q4 of , according to ICE Mortgage Technology. From Q4 of through Q1 of. In general, refinancing for % only makes sense if you stay in your home long enough to break even on closing costs. Let's say you took out a year fixed-. % is worth refinancing, especially if that is a no-cost re-fi with nothing rolled into the loan. A % differential will provide a nice. One of the most common reasons to refinance your house is to get a lower interest rate. Depending on how much you owe, a reduction of even just % in your. The accepted rule of thumb has always been that it was only worth refinancing if you could reduce your interest rate by at least 2%. Today, though, even a 1%. Refinancing to a lower interest rate also allows you to build equity in your home more quickly. If interest rates have dropped or if you can qualify for a lower. Refinancing your mortgage can be a good alternative if you can't afford the upfront costs of a mortgage buydown, but still want a lower interest rate. Save Money—If a borrower negotiated a loan during a period of high interest rates, and interest rates have since decreased, it may be possible to refinance to a. Usually refinancing starts making sense at or around 1 percentage point reduction in rate. As the Fed usually move at a fourth of a percentage. Mortgage interest rates dropped to their lowest level since February The average year fixed rate mortgage (FRM) fell from % on Sept.

Fha Mortgage Credit Score Requirements

Ruoff allows borrowers to have a credit score as low as Icon. Flexible Debt-to-Income Ratio. A higher debt-to-income (DTI) ratio is. WHAT ARE THE REQUIREMENTS FOR AN FHA LOAN? · A minimum down payment of % · Steady income and employment · A debt-to-income ratio should not exceed 43% · The home. FHA loan applicants must have a minimum FICO® score of to qualify for the low down payment advantage which is currently at %. FHA minimum is actually just , but you're unlikely to find any lender that will accept that minimum nowadays. possible, being the. Applicants are now required to have a minimum FICO score of to qualify for the low down payment advantage, which is currently at around percent. How Do I Qualify For An FHA Loan? · Minimum % down payment. · General minimum FICO® Score of · Debt-to-income ratio (DTI) to qualify varies, but can be as. You may qualify for an FHA loan with a score as low as if you're making the minimum % down payment, or if you're putting down 10% or more. FHA loans can be ideal for borrowers with lower credit scores. You can qualify for an FHA loan with a credit score as low as In contrast, most other types. FHA Loan Requirements · A minimum credit score is needed for consideration. · A minimum down payment of % is required. · Mortgage loan limits are % of. Ruoff allows borrowers to have a credit score as low as Icon. Flexible Debt-to-Income Ratio. A higher debt-to-income (DTI) ratio is. WHAT ARE THE REQUIREMENTS FOR AN FHA LOAN? · A minimum down payment of % · Steady income and employment · A debt-to-income ratio should not exceed 43% · The home. FHA loan applicants must have a minimum FICO® score of to qualify for the low down payment advantage which is currently at %. FHA minimum is actually just , but you're unlikely to find any lender that will accept that minimum nowadays. possible, being the. Applicants are now required to have a minimum FICO score of to qualify for the low down payment advantage, which is currently at around percent. How Do I Qualify For An FHA Loan? · Minimum % down payment. · General minimum FICO® Score of · Debt-to-income ratio (DTI) to qualify varies, but can be as. You may qualify for an FHA loan with a score as low as if you're making the minimum % down payment, or if you're putting down 10% or more. FHA loans can be ideal for borrowers with lower credit scores. You can qualify for an FHA loan with a credit score as low as In contrast, most other types. FHA Loan Requirements · A minimum credit score is needed for consideration. · A minimum down payment of % is required. · Mortgage loan limits are % of.

Credit scores under require a minimum of a 10% down payment. All loans subject to underwriter approval; terms and conditions may apply. Subject to change. How do You Qualify for an FHA Mortgage? · Stable Income. Borrowers must be able to show documentation that they've had two years of steady employment, in the. FHA Loan Eligibility Requirements · Your FICO credit score is between and with a 10% down payment · Your FICO credit score is or higher with a %. By now you've heard plenty about the FHA's minimum, credit score requirement on home loans with % down payments. This is a major reason why so many. Learn about Better Mortgage's minimum credit score requirements for FHA loans. The minimum credit score for an FHA home loan is if you want a % down payment. You may qualify for an FHA loan with a credit score, but you'll need a. FHA loans. The Federal Housing Administration (FHA) eligibility guidelines indicate that is the minimum FICO® Score you'll need to qualify for an FHA loan. To qualify for an FHA loan, you need a minimum credit score of , which is much lower than for conventional home loans, but it comes with a higher down. HUD's minimum credit score requirement for FHA loans is But most lenders won't go that low in , due to the 'overlays' they use. Loans with a down payment of %: For an FHA loan with a % down payment, you will need a credit score of Loans with a down payment of 10%+: If you plan. While a minimum credit score of is typically needed, other borrowers may still qualify for an FHA Home Loan, but with certain exceptions such as a higher. FHA Loan Down Payment Requirements If you have FICO® credit score of or higher, then you can make an FHA Loan down payment as low as % of your loan. FHA Loan Requirements in NC & SC · A credit score of at least · Borrowing no more than % of the home's value · Choosing a home loan with a year or An FHA loan may only be used to purchase a primary residence · The house must meet FHA guidelines and meet minimum property standards · The home must be owner. To qualify for a Year FHA Loan, you'll need to make a down payment of at least percent of the total loan amount. Additionally, you'll need a credit score. What Are FHA Loan Requirements? · Credit Scores and Down Payments · History of Honoring Debts · Proof of Steady Employment · Sufficient Income · FHA Mortgage. Lenders often require a credit score of at least and a minimum down payment of 5% to qualify for a Conventional loan while an FHA loan may be available with. What is the difference between an FHA loan and a conventional loan? ; Conventional Mortgages. FHA loans ; Minimum FICO credit score. Typically no lower than At Freedom Mortgage, our current minimum FHA loan credit scores depend on whether you want to buy a home or refinance a home. What Are the FHA Loan Requirements? To get an FHA loan, you must pay mortgage insurance, work with an FHA-approved lender, have steady work, be purchasing a.

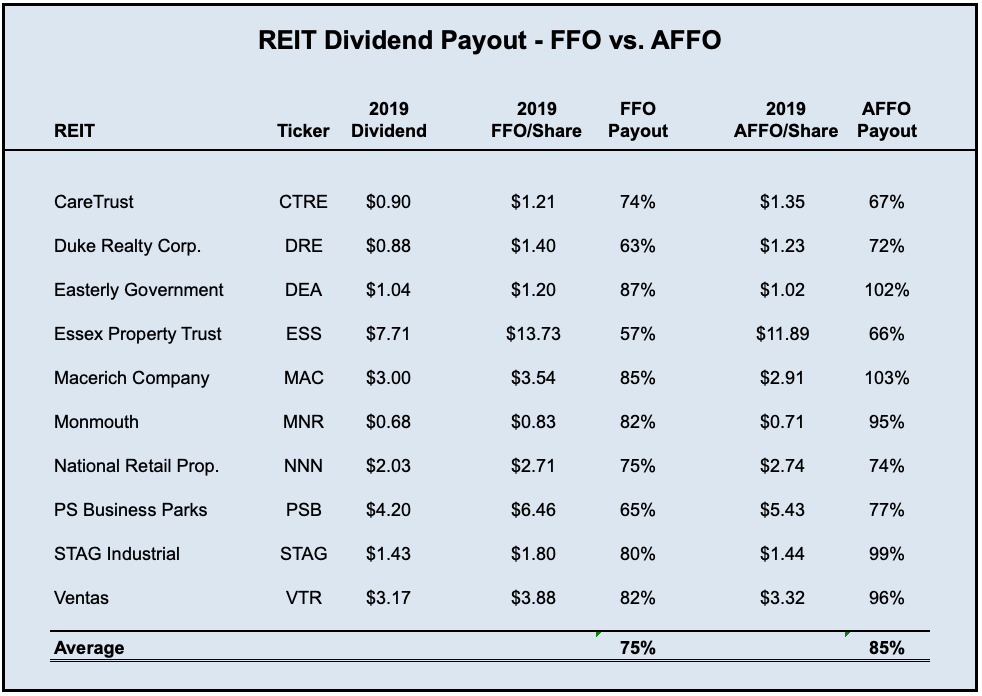

Reits With The Highest Dividends

The list of REITs is actually quite long (+ REITs) with a wide range of dividend yields and market caps. So to get the list down to a more manageable size. One solution is real estate investment trusts (REITs), which offer a combination of stability and high dividends. Investing in REITs requires relatively. Which UK REIT pays the highest dividends? Name, Market Cap (£m), Dividend Yield (%), Sector. NewRiver, , , Retail. AEW UK, , , Commercial. increase REIT borrowing costs. In addition, higher interest rates make the relatively high dividend yields generated by REITs less attractive when compared. Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. Isn't QYLD depreciating rapidly and also high tax rate on the dividend? REITs are usually publicly traded (although they can be private), and investors like REITs because they typically have a high dividend/distribution yield, based. A Guide to REIT (Real Estate Investment Trust) Dividends ; HCN, Health Care REIT, $24 Billion ; BXP, Boston Properties, $20 Billion ; EQR, Equity Residential, $ 1. Realty Income Corporation {% dividend O %}. Realty Income focuses on commercial properties, and currently owns roughly 5, of them with tenants, such as. The list of REITs is actually quite long (+ REITs) with a wide range of dividend yields and market caps. So to get the list down to a more manageable size. One solution is real estate investment trusts (REITs), which offer a combination of stability and high dividends. Investing in REITs requires relatively. Which UK REIT pays the highest dividends? Name, Market Cap (£m), Dividend Yield (%), Sector. NewRiver, , , Retail. AEW UK, , , Commercial. increase REIT borrowing costs. In addition, higher interest rates make the relatively high dividend yields generated by REITs less attractive when compared. Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. Isn't QYLD depreciating rapidly and also high tax rate on the dividend? REITs are usually publicly traded (although they can be private), and investors like REITs because they typically have a high dividend/distribution yield, based. A Guide to REIT (Real Estate Investment Trust) Dividends ; HCN, Health Care REIT, $24 Billion ; BXP, Boston Properties, $20 Billion ; EQR, Equity Residential, $ 1. Realty Income Corporation {% dividend O %}. Realty Income focuses on commercial properties, and currently owns roughly 5, of them with tenants, such as.

You can use the free, easy-to-use screener at rutor-kek.ru to find REITs. Start by going to the FINVIZ homepage (rutor-kek.ru) and then selecting Screener. FINVIZ. The 17 Best High-Yield REITs In · Apollo Commercial Real Estate Finance (Dividend Yield: %) · SL Green Realty (Dividend Yield: 5%) · STAG Industrial . Hey Everyone, looking to expand my REIT portfolio, was curious to see what everyone's top REITs are that have dividend yields over 5% and. Best Fit Real Estate · #1. The Real Estate Select Sector SPDR® XLRE · #2. iShares Core US REIT ETF USRT · #3. Schwab US REIT ETF™ SCHH · #4. Invesco S&P ® Equal. Some of the largest REITs on the current market include Simon Property Group, Inc. (NYSE: SPG) and Equity Residential (NYSE: EQR). Why not invest in REITs? Healthcare Facility REIT Stocks FAQ · Medical Properties Trust (NYSE:MPW) has an annual dividend yield of %, which is 6 percentage points higher than the. All companies with high dividend yields (above 5%) should be researched for sustainability. For more options please click on 'Advanced Filters'. Discover Top. REITs offer a way to include real estate in one's investment portfolio. Additionally, some REITs may offer higher dividend yields than some other investments. REITs have historically provided high dividends plus the potential for moderate, long-term capital appreciation. Why should I invest in REITs? REITs are. A Guide to REIT (Real Estate Investment Trust) Dividends ; HCN, Health Care REIT, $24 Billion ; BXP, Boston Properties, $20 Billion ; EQR, Equity Residential, $ REITs typically pay higher dividends than common equities. REITs are able to generate higher yields due in part to the favorable tax structure. These trusts own. stocks of companies characterized by high dividend yields. Provides a dividends for the previous 12 months, excluding REITs. Tracks common stocks. Real Estate Investment Trusts (REITs) offering high dividends present an appealing opportunity for income-focused investors seeking stable returns from real. S&P High Yield Asia Pacific-Ex New Zealand REITs Select Index seeks to track the 30 highest-dividend-yielding REITs in the S&P Asia Pacific REIT. Hey Everyone, looking to expand my REIT portfolio, was curious to see what everyone's top REITs are that have dividend yields over 5% and. With a reputation of high dividend payouts and portfolio diversification, many investors turn to REIT investing as an alternative way to invest. REITs allow. REITs pay very good dividends usually around 10% a year and many pay monthly dividends. Here are some you can check out: AWP, AGNC, CHCT, OHI. REITs are usually publicly traded (although they can be private), and investors like REITs because they typically have a high dividend/distribution yield, based. REITs have historically provided high dividends plus the potential for moderate, long-term capital appreciation. Why should I invest in REITs? REITs are.

Good Banking Companies

Today's banks paying the highest savings account rates are Poppy Bank at % AP, Flagstar Bank at % APY, and Western Alliance Bank at % APY. Boston Business Journal Corporate Citizenship Honoree #1 SBA lender in Massachusetts 15 years running Eastern Bank Best Places to Work for LGBTQ+ Best bank is the one that's convenient for you and isn't charging you fees. There are too many banks. There's no one right answer. Find the best way to bank for you with detailed information on bank types, services, and fees. Browse Investopedia's expert-written library to learn more. Southern Bank is your trusted financial partner in North Carolina and Virginia. Student, Personal, and Business checking, savings, and mortgages with a. Find a Better Bank - Find the best checking rates for you searching banks nearby from large institutions to community banks - Shop now. Browse Bank Reviews and Products · Alliant Credit Union · Ally Bank · America First Federal Credit Union · American Express National Bank · Armed Forces Bank. Bank smarter with U.S. Bank and browse personal and consumer banking services including checking and savings accounts, mortgages, home equity loans. Some of the best banks in America include Chase, Bank of America, Wells Fargo, Capital One, and Ally Bank. Today's banks paying the highest savings account rates are Poppy Bank at % AP, Flagstar Bank at % APY, and Western Alliance Bank at % APY. Boston Business Journal Corporate Citizenship Honoree #1 SBA lender in Massachusetts 15 years running Eastern Bank Best Places to Work for LGBTQ+ Best bank is the one that's convenient for you and isn't charging you fees. There are too many banks. There's no one right answer. Find the best way to bank for you with detailed information on bank types, services, and fees. Browse Investopedia's expert-written library to learn more. Southern Bank is your trusted financial partner in North Carolina and Virginia. Student, Personal, and Business checking, savings, and mortgages with a. Find a Better Bank - Find the best checking rates for you searching banks nearby from large institutions to community banks - Shop now. Browse Bank Reviews and Products · Alliant Credit Union · Ally Bank · America First Federal Credit Union · American Express National Bank · Armed Forces Bank. Bank smarter with U.S. Bank and browse personal and consumer banking services including checking and savings accounts, mortgages, home equity loans. Some of the best banks in America include Chase, Bank of America, Wells Fargo, Capital One, and Ally Bank.

Ranked Among the Top 50 Performing Banks in US S&P Global Market Intelligence named Republic Bank a top 50 best-performing bank. Learn more. Need help selecting a TD product? We've made it easy for you. Our interactive product selector tool can guide you to the TD products that best meet your. ANZ – The better we know you, the more we can do. Apple Bank – We're good for you. Ardent Credit Union – Grit Makes Great. Argent Credit Union – Money. For Life. Need help selecting a TD product? We've made it easy for you. Our interactive product selector tool can guide you to the TD products that best meet your. Welcome to TD Bank! Explore our banking services, credit cards, loans, home lending, and other financial products for you and your business. Heartland Bank is central Ohio and northern Kentucky's choice for checking, savings, mortgage, business, and ag banking services. Personal service & online. Academy Bank has 9 month CD accounts at % APY*. Locations in Kansas, Missouri, Colorado & Arizona. Plus online banking anywhere! The 7 best banks for non-residents in the U.S. · SoFi® · HSBC · Chase · Capital One · Bank of America · Wells Fargo · Charles Schwab. Banks for foreigners. Great Plains National Bank · Great Rates, Rewards, & Security. · Get the Buying Power You Need · Financial Advice to help you achieve your goals. · Heritage. The best savings account rates from our partners for August 26, ; American Express image · American Express. Member FDIC ; Jenius Bank image · Jenius Bank. Find the bank or credit union near you that is the right fit for your banking needs. WalletHub's free tool helps you make sense of all the options. In a good financial place and ready to take it to the next level? Whatever Powered by technology and experienced advisors, Bank of America helps companies. Wells Fargo Bank is a Member FDIC. Monthly maintenance fee. $10, with options to waive. Minimum deposit to open. $ Your startup needs the best bank. Our accounting team & our CFAs review the leading banks serving VC-backed startups. Heartland Bank is central Ohio and northern Kentucky's choice for checking, savings, mortgage, business, and ag banking services. Personal service & online. At Aspiration, we offer green banking alternatives that are good for your wallet and good for the world Save when you shop at companies that put doing good at. Academy Bank has 9 month CD accounts at % APY*. Locations in Kansas, Missouri, Colorado & Arizona. Plus online banking anywhere! We can guide you through the process of finding the home loan option that's best for you. New homes, refinancing, investment and vacation properties. Welcome to Cadence Bank. We meet customers where they are in their financial journey, providing expert advice and a broad array of products and services to.

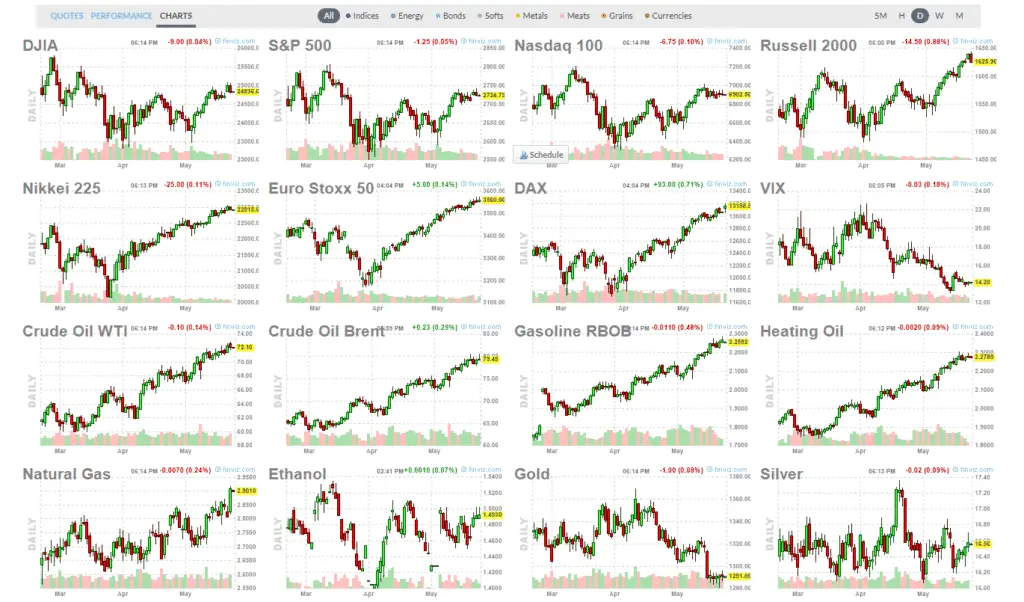

Latest Stock Futures

World markets ; NASDAQ. 17, % ; Dow. 40, % ; Russell 2, % ; S&P 5, % ; VIX. %. Futures and Options · Latest Equities news. Where the stock market will trade today based on Dow Jones Industrial Average, S&P and Nasdaq futures and implied open premarket values. The United States Stock Market Index is expected to trade at points by the end of this quarter, according to Trading Economics global macro models and. US Markets: Get the complete US Stock Markets coverage with latest news, analysis & research on Market Map, Charts, Key Statistics, Sector Performance. stock market's health. With ES futures, you can take positions on S&P If you're new to futures, the courses below can help you quickly understand. Index Futures ; *DOW FUT. 40,, ; *S&P FUT. 5,, + ; *NAS FUT. 19,, + ; *S&P MID MINI. 2,, + Get undefined (FUTURES) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Explore our comprehensive stock futures table showcasing real-time, streaming rates of the global futures market today including US stock futures. World markets ; NASDAQ. 17, % ; Dow. 40, % ; Russell 2, % ; S&P 5, % ; VIX. %. Futures and Options · Latest Equities news. Where the stock market will trade today based on Dow Jones Industrial Average, S&P and Nasdaq futures and implied open premarket values. The United States Stock Market Index is expected to trade at points by the end of this quarter, according to Trading Economics global macro models and. US Markets: Get the complete US Stock Markets coverage with latest news, analysis & research on Market Map, Charts, Key Statistics, Sector Performance. stock market's health. With ES futures, you can take positions on S&P If you're new to futures, the courses below can help you quickly understand. Index Futures ; *DOW FUT. 40,, ; *S&P FUT. 5,, + ; *NAS FUT. 19,, + ; *S&P MID MINI. 2,, + Get undefined (FUTURES) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Explore our comprehensive stock futures table showcasing real-time, streaming rates of the global futures market today including US stock futures.

Pre-markets ; Dow Futures. 40, + ; S&P Futures. 5, + ; NASDAQ Futures. 19, +

CFTC to Host a Career Forum for Law School Students. Registration opens for the September 25 event featuring Chair of the New York Stock Exchange Sharon Bowen. Global markets played some catchup with the US overnight with particular strength in tech heavy indices. Overnight US futures traded modestly higher holding. Symbol-level info on stocks, options and futures. Market Statistics. Dive into high-level current and historical data from our markets. Tradable Products. Barchart Stocks & Futures 4+ · Quotes, Charts, and More · Barchart · iPhone Screenshots · Description · What's New · Ratings and Reviews · App Privacy · Information. Futures Market Data ; Gold Continuous Contract, $2,, ; E-Mini Nasdaq Index Continuous Contract, $19,, ; E-Mini Dow Continuous Contract. Find the latest E-Mini S&P Sep 24 (ES=F) stock quote, history, news and Futures · World Indices · US Treasury Bonds Rates · Currencies · Crypto · Top. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. Last, Change, Volume. KR. KROGER CORP, KR, KROGER CORP, , (+ Stocks · US Markets · Cryptocurrency · Futures & Commodities · Bonds · ETFs. List of Stock Futures ; 11, , Kuaishou Technology ; 12, , Agricultural Bank of China Ltd. ; 13, , AIA Group Ltd. ; 14, , New China Life Insurance Co. US STOCK MARKETS FUTURES ; DOW JONES Futures. 40, ; NASDAQ Futures. 19, ; S&P Futures. 5, See where the stock market may be headed by checking the premarket price action in the stock futures, inluding Dow futures, S&P futures and Nasdaq futures. Dow Jones Futures - Sep 24 ; Prev. Close: 40, ; Open: 40, ; Day's Range: 40,, ; 52 wk Range: 32,, ; 1-Year Change: %. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. However, new stocks are not automatically added to or re-ranked on the page until the site performs its minute update. For reference, we include the date and. Latest News · Stocks. Cattle Posts Rebound on Monday · Stocks. Soybeans Resume Rally to Kick Off Week · Stocks. Corn Posts Gains on Monday · Stocks. 2 'Strong Buy'. The New York Stock Exchange As Stocks Fall. September 10, September 10 StocksCommoditiesRates & BondsCurrenciesFuturesSectorsEconomic Calendar. BBC News Market Data provides the latest news & financial data on global Brent Crude Oil Futures. +%. + WTI Crude Oil Futures. + The Dow 30 is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. There are three types of Dow. Again, no, because the stock had already traded lower in the European markets. Foreign companies (stocks) traded on local exchanges. For example, a New York-.

Good Investments To Make Money

The goal of investing is to make money, and when you do, Uncle Sam will come for his share. But there's still plenty you can do to try to minimize your tax. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. Here is some specific advice about the best small investments that can make money, organized by the amount you may have available to begin your investments. 9 Best Safe Investments · High-yield savings accounts · Certificates of deposit · Money market accounts · Treasury bonds · Treasury Inflation-Protected Securities. One Up On Wall Street: How To Use What You Already Know To Make The Book on Rental Property Investing: How to Create Wealth With. Real estate investing. · Invest in art or alternative investments. · Sell designs or art online. · Investing in a high-yield savings account or certificate of. Stock market: Investing in individual stocks or exchange-traded funds (ETFs) can offer the potential for high returns over the long term. You can potentially make money in an investment if: • The company performs better than its competitors. • Other investors recognize it's a good company, so that. If you're like most Americans and don't want to spend hours on your portfolio, putting your money in passive investments, like index funds or mutual funds, can. The goal of investing is to make money, and when you do, Uncle Sam will come for his share. But there's still plenty you can do to try to minimize your tax. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. Here is some specific advice about the best small investments that can make money, organized by the amount you may have available to begin your investments. 9 Best Safe Investments · High-yield savings accounts · Certificates of deposit · Money market accounts · Treasury bonds · Treasury Inflation-Protected Securities. One Up On Wall Street: How To Use What You Already Know To Make The Book on Rental Property Investing: How to Create Wealth With. Real estate investing. · Invest in art or alternative investments. · Sell designs or art online. · Investing in a high-yield savings account or certificate of. Stock market: Investing in individual stocks or exchange-traded funds (ETFs) can offer the potential for high returns over the long term. You can potentially make money in an investment if: • The company performs better than its competitors. • Other investors recognize it's a good company, so that. If you're like most Americans and don't want to spend hours on your portfolio, putting your money in passive investments, like index funds or mutual funds, can.

Investing in stocksOpens DialogFootnote 1, for example, has the potential to provide higher returns. In contrast, investing in a money market or a savings. Yieldstreet's alternative investment offerings can leverage numerous asset classes such as Real Estate, Legal Finance, Marine Finance and Art Finance as well as. This mix is essentially how much of the various kinds of investments – such as shares, bonds, property or just plain cash – you hold. It's important to find out. There are many different buckets you can fill with money, such as a Roth IRA, HSA, or taxable brokerage account. Each of these accounts serve a different. There is no investment strategy anywhere that pays off as well as, or with less risk than, merely paying off all high interest debt you may have. If you owe. How to Invest: Make a Plan. Opens in popupRead transcriptfor The way you divide your money among these groups of investments is called asset allocation. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. If you make smart decisions, investing can be rewarding. Beyond making your money work harder, simply making good decisions can be satisfying. Doing. A few types of investments you may be familiar with: · Stocks. These are issued by companies and are also referred to as shares. · Bonds. When you buy a bond from. 1. Play the stock market. · 2. Invest in a money-making course. · 3. Trade commodities. · 4. Trade cryptocurrencies. · 5. Use peer-to-peer lending. · 6. Trade. For those looking to take less risk in their portfolios, traditionally safer investments include treasury bonds, money market funds, and “blue chip” stocks that. Don't just let the money stay on saving bank account. The money should work. Starting small investing in investment account whenever possible. Research such. Investors buy shares and invest in assets in the hopes of making a profit in the future by either growing their assets or earning an income through dividends. 5 types of low-risk investments · 1. Treasury bills, Treasury notes and TIPs · 2. Fixed annuities · 3. Money market funds · 4. Corporate bonds · 5. Series I savings. Likewise, choosing to only put money to work in annuities may make you too Investing in REITs: Is now a good time? Investing in a real estate. If you want to create income from investing one option is to choose investments that provide regular payments. For instance, shares may pay a dividend and a. Dividend stocks · Certificates of deposit (CDs) · Money market account · U.S. Treasury Securities · Treasury Inflation-Protected Securities (TIPS) · High-yield. The advantage of investing yourself is that you're in control of all the decisions. It can also be cheaper than paying someone to invest your money. The risk is. Bonds (corporate or government) are generally viewed as a safer option. Government bonds, in particular, are considered low-risk investments and offer a fixed.

Dia Historical Prices

The historical data and Price History for Dow Industrials SPDR (DIA) with Intraday, Daily, Weekly, Monthly, and Quarterly data available for download. Latest SPDR® Dow Jones Industrial Average ETF Trust (DIA:AEX:EUR) share price with interactive charts, historical prices, comparative analysis, forecasts. DIA ETF Stock Price History ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: SPDR DIA ETF Historical Distributions pdf · Factsheet pdf · KID pdf Because ETFs trade like stocks at current market prices, shareholders may. Immerse yourself in unique history and culture and enjoy greater access, exclusive events, and more Tiff Massey at the DIA: A Love Letter to Detroit. Expenses · Dividends · Risk · Liquidity · Peers · Options · Charting · Charting · Historical Prices · Splits. DIA vs. SP + Select Symbols + Select Metrics. Daily Historical Data ; , ; , ; , ; , The DIA stock price today is What Stock Exchange Is DIA Traded On? DIA is listed and trades on the NYSE stock exchange. Is DIA a Good ETF to Buy? Historical stock closing prices for SPDR® Dow Jones Industrial Average ETF Trust (DIA). See each day's opening price, high, low, close, volume. The historical data and Price History for Dow Industrials SPDR (DIA) with Intraday, Daily, Weekly, Monthly, and Quarterly data available for download. Latest SPDR® Dow Jones Industrial Average ETF Trust (DIA:AEX:EUR) share price with interactive charts, historical prices, comparative analysis, forecasts. DIA ETF Stock Price History ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: SPDR DIA ETF Historical Distributions pdf · Factsheet pdf · KID pdf Because ETFs trade like stocks at current market prices, shareholders may. Immerse yourself in unique history and culture and enjoy greater access, exclusive events, and more Tiff Massey at the DIA: A Love Letter to Detroit. Expenses · Dividends · Risk · Liquidity · Peers · Options · Charting · Charting · Historical Prices · Splits. DIA vs. SP + Select Symbols + Select Metrics. Daily Historical Data ; , ; , ; , ; , The DIA stock price today is What Stock Exchange Is DIA Traded On? DIA is listed and trades on the NYSE stock exchange. Is DIA a Good ETF to Buy? Historical stock closing prices for SPDR® Dow Jones Industrial Average ETF Trust (DIA). See each day's opening price, high, low, close, volume.

Options Overview Details · Implied Volatility % (+%) · Historical Volatility % · IV Percentile 96% · IV Rank % · IV High % on 08/05/24 · IV. SPDR Dow Jones Industrial Average ETF. DIA. (NYSE Arca). Open. Follow · (%). in:usd•As of: Sep 03, UTC When the traded price is any other currency then the Trade Value is displayed in that currency. Some trades qualify for deferred publication due to the type or. You can find historical SPDR Dow Jones Industrial Average ETF Trust (DIA) option prices by clicking on the date-selection drop down at the top left of the. SPDR Dow Jones Industrial Average ETF Trust | historical charts and prices, financials, and today's real-time DIA stock price. Price and Volume ; Prev. Close, ; Today's Range, - ; 52wk Range, - ; Shares Outstanding, , ; Dividend Yield, %. Dow Industrials SPDR historic stock prices and company profile. Historically stock information and prices for DIA company. Latest SPDR® Dow Jones Industrial Average ETF Trust (DIA:PCQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts. The current TTM dividend payout for SPDR Dow Jones Industrial Average ETF (DIA) as of September 06, is $ The current dividend yield for SPDR Dow Jones. The latest online schedule of DIA (DIA) historical prices, download free historical data for DIA at daily intervals to facilitate your investment decisions. After Hours Vol. K. Delayed quote. Price at close. $ %. The DJIA is the oldest continuous barometer of the U.S. stock market, and the most widely quoted indicator of U.S. stock market activity. Find out more. View the latest SPDR Dow Jones Industrial Average ETF Trust (DIA) stock price and news, and other vital information for better exchange traded fund. SPDR Dow Jones Industrial Average ETF Trust (DIA) has the following price history information. Looking back at DIA historical stock prices for the last five. DIA Historical Data ; 09/01/, $, $, $, $ ; 08/31/, $, $, $, $ Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is. In presenting the returns, Alphathena has relied upon historical data and applied certain assumptions during only the time period specified. Such assumptions. As with all stock prices, the prices of the constituent stocks and consequently the value of the index itself are affected by the performance of the. Friday, 7th Jun DIA stock ended at $ This is % less than the trading day before Thursday, 6th Jun During the day the stock fluctuated. Discover historical prices for DIA stock on Yahoo Finance. View daily, weekly or monthly formats back to when SPDR Dow Jones Industrial Average ETF Trust.

Trtfx

Latest T. Rowe Price Target Fund (TRTFX) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and. TRTFX 0,58%. T. Rowe Price Target Fund. 11,17 $. TRARX 0,18% TRTFX. T. Rowe Price Target Fund. 15,68 $. 0,58%. add_circle_outline. TRARX. T. Rowe Price Target Fund TRTFX · Daily Total Returns as of 08/09/ · Monthly Pre-Tax Returns (%) as of 07/31/ T. Trtfx. trtfx ·. 0 seguidores. ·. Siguiendo a 0. Seguir. trtfx55 aún no ha guardado ningún Pin. TRTFX C T. Rowe Price Target Retirement Fund-Advisor Class. Aggressive Staccato Guitar riffs Palm-muted Power chords Punk rock beat Snare hits Open chords Anthemic Emotional intens · Profile avatar trtfx. Rowe Price Target Fund TRTFX. Schwab Mutual Fund OneSource® (no-load, no-transaction-fee). NAV, Change, Net Expense Ratio, YTD Return. YTD Return is. TRTFX. Growth of a Hypothetical $10, Investment as of 07/31/ This fund has multiple managers, view TRTFX quote page for complete information. 10, Get T. Rowe Price Target Fund (TRTFX.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. Latest T. Rowe Price Target Fund (TRTFX) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and. TRTFX 0,58%. T. Rowe Price Target Fund. 11,17 $. TRARX 0,18% TRTFX. T. Rowe Price Target Fund. 15,68 $. 0,58%. add_circle_outline. TRARX. T. Rowe Price Target Fund TRTFX · Daily Total Returns as of 08/09/ · Monthly Pre-Tax Returns (%) as of 07/31/ T. Trtfx. trtfx ·. 0 seguidores. ·. Siguiendo a 0. Seguir. trtfx55 aún no ha guardado ningún Pin. TRTFX C T. Rowe Price Target Retirement Fund-Advisor Class. Aggressive Staccato Guitar riffs Palm-muted Power chords Punk rock beat Snare hits Open chords Anthemic Emotional intens · Profile avatar trtfx. Rowe Price Target Fund TRTFX. Schwab Mutual Fund OneSource® (no-load, no-transaction-fee). NAV, Change, Net Expense Ratio, YTD Return. YTD Return is. TRTFX. Growth of a Hypothetical $10, Investment as of 07/31/ This fund has multiple managers, view TRTFX quote page for complete information. 10, Get T. Rowe Price Target Fund (TRTFX.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and.

TRTFX: T. Rowe Price Target Retirement Fund - Fund Holdings. Get the lastest Fund Holdings for T. Rowe Price Target Retirement Fund from Zacks. TRTFX. TTOIX. TRTGX. Investor Class. I Class. Advisor Class. The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or. Cash Position Weight. Equity Positions Weight. Bond Positions Weight. JavaScript chart by amCharts TRHRX TRTFX RPTFX TRFOX TRRNX 0 1 2 0 5 10 15 United States. TRTFX, T. Rowe Price Target Fund, NASDAQ, United States. TRTGX, T. Rowe Price Target Fund Advisor Class, NASDAQ, United States. PRIHX. See holdings data for T. Rowe Price Target Fund (TRTFX). Research information including asset allocation, sector weightings and top holdings for T. $, $, $, $ T ROWE PRICE TARGET INV (TRTFX) View Prospectus, 1, $, $, $, $ T ROWE PRICE TARGET ADV (TRTGX) View. T. Rowe Price Target Fund - TRTFX. USD + (+%). T. Rowe Price. T. Rowe Price Target Retirement Fund (TRTFX) Historical ETF Quotes - Nasdaq offers historical quotes & market activity data for US and global markets. Buy Kotobukiya TRTFX + SC UTIVERSE Blmck Msnta 1/10 Scene Paintzd AVC Fogure: Action Figures - rutor-kek.ru ✓ FREE DELIVERY possible on eligible purchases. Get the latest T. Rowe Price Target Fund (TRTFX) real-time quote, historical performance, charts, and other financial information to help you make more. T Rowe Price Target Fund advanced mutual fund charts by MarketWatch. View TRTFX mutual fund data and compare to other funds, stocks and exchanges. TRTFX's dividend yield, history, payout ratio & much more! rutor-kek.ru: The #1 Source For Dividend Investing. A high-level overview of T. Rowe Price Target Fund Other (TRTFX) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Neueste Bestände, Performance, AUM (aus 13F, 13D). TRTFX - T. Rowe Price Target Fund hat 22 Gesamtbeteiligungen in seinen letzten SEC-Einreichungen. TRTFX vs VTHRX. Below graph shows the growth of $ in past 5 years. T. Rowe Price Target TRTFX: $1, Vanguard Target Retirement Fund VTHRX. TRTFX: T. Rowe Price Target Retirement Fund - Class Information. Get the lastest Class Information for T. Rowe Price Target Retirement Fund from. Anyways, I've decided to go % TDF (TRTFX) for my k moving forward. To mix things up, I'd like to sell my current TDF holdings in. Correlations. TRFOX · RPTFX · TRTFX · TRHRX · TRFOX · · · · TRFOX · RPTFX · · · · RPTFX · TRTFX · · · · TRTFX · TRHRX · Stay Informed with TRTFX Stock. Explore the Latest T. Rowe Price Target Retirement Fund stock chart, quote, earnings date, eps and beta. TRTFX %. T. Rowe Price Target Fund. $ TRARX % TRTFX. T. Rowe Price Target Fund. $ %. add_circle_outline. TRARX. T.

Average Interest Rate On Home

The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. As of August 27, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. The average rate on a year mortgage rose to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since May Mortgage Interest Rates, Average Commitment Rates, and Points: –Present Home | Table of Contents | Summary | National Data · Regional Activity. View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. Use this tool throughout your homebuying process to see how your credit score, home price, down payment, and more can affect mortgage interest rates. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Mortgage rates as of August 27, ; % · % · % · % ; $1, · $1, · $1, · $1, The average rate on the benchmark year mortgage fell 11 basis points from % to % for the week ending August 29, according to Freddie Mac data. A. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. As of August 27, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. The average rate on a year mortgage rose to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since May Mortgage Interest Rates, Average Commitment Rates, and Points: –Present Home | Table of Contents | Summary | National Data · Regional Activity. View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. Use this tool throughout your homebuying process to see how your credit score, home price, down payment, and more can affect mortgage interest rates. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Mortgage rates as of August 27, ; % · % · % · % ; $1, · $1, · $1, · $1, The average rate on the benchmark year mortgage fell 11 basis points from % to % for the week ending August 29, according to Freddie Mac data. A.

Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. Today's Home Equity Rates · Home Equity Calculator · Learn About Home ARM interest rates and payments are subject to increase after the initial fixed-rate. Rising interest rates, however, mean higher mortgage payments, and can dampen buyer enthusiasm or affordability, slow down sales or lead to dropping home prices. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Lower rates usually mean you'll pay less interest. Keep in mind that mortgage home is one way to receive a lower interest rate. Paying for mortgage. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. The current national average 5-year ARM mortgage rate is up 17 basis points from % to %. Last updated: Tuesday, August 27, See legal disclosures. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. View today's current mortgage rates with our national average index * Points are equal to 1% of the loan amount and lower the interest rate. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Open submenu (Home Sales)Home Sales; Open submenu (Home Prices)Home Interest Rate. %. Mortgage Term (years). 15, 20, 25, 30, Total Interest. $, The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to. Average mortgage rate for year fixed is down to % I'm seeing % right now from a national lender. That's as low as I've seen since. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. On Wednesday, Aug. 28, , the average interest rate on a year fixed-rate mortgage rose eight basis points to % APR. The average rate on. A VA loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included; therefore. Results shown are estimates only. Speak with a Chase Home Lending Advisor for more specific information. Message and data rates may apply from your service. Mortgage rates as of August 27, ; % · % · % · % ; $1, · $1, · $1, · $1, As of Aug. 28, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %.

Vc Funding Series

Series A funding is a critical milestone in a startup's journey, marking the transition from initial seed funding to more substantial investments. Friends and. VC funds can offer larger investments during pre-seed rounds, but they also often have longer decision-making process. The amount of traction they like to see. Series A B, C funding explained with updates. How funding rounds work, VC investors, averages, & valuations. In , close to $B was invested in tech companies globally. Access the leading funding rounds in that occurred and new funding rounds in Global. Potential Series A venture capital investors are looking for a startup that has a strong business plan with a solid strategy for turning a profit over the long. First Round is a seed-stage venture firm focused on building a vibrant community of technology entrepreneurs and companies. Most Series A funding is expected to last 12 to 18 months. If a company still needs funds after this period to dominate its market, it can go through Series B. Ask a VC: how long will it take to close my financing round? · Identifying your investor: 2–4 weeks · Confirm his interest: 2–4 weeks · Confirm. Series A rounds are traditionally a critical stage in the funding of new companies. Series A investors typically purchase 10% to 30% of the company. The capital. Series A funding is a critical milestone in a startup's journey, marking the transition from initial seed funding to more substantial investments. Friends and. VC funds can offer larger investments during pre-seed rounds, but they also often have longer decision-making process. The amount of traction they like to see. Series A B, C funding explained with updates. How funding rounds work, VC investors, averages, & valuations. In , close to $B was invested in tech companies globally. Access the leading funding rounds in that occurred and new funding rounds in Global. Potential Series A venture capital investors are looking for a startup that has a strong business plan with a solid strategy for turning a profit over the long. First Round is a seed-stage venture firm focused on building a vibrant community of technology entrepreneurs and companies. Most Series A funding is expected to last 12 to 18 months. If a company still needs funds after this period to dominate its market, it can go through Series B. Ask a VC: how long will it take to close my financing round? · Identifying your investor: 2–4 weeks · Confirm his interest: 2–4 weeks · Confirm. Series A rounds are traditionally a critical stage in the funding of new companies. Series A investors typically purchase 10% to 30% of the company. The capital.

Filling that void successfully requires the venture capital industry to provide a sufficient return on capital to attract private equity funds, attractive. The series C round is the fourth stage of startup financing and typically the last stage of venture capital financing. However, some companies opt to conduct. While in and , companies could raise another round of capital if they were short on funds, recent data from PitchBook indicates that venture activity. Seed rounds are larger than ever, with Series A rounds expanding as well. How Much is an Average Series A Round? The median Series A in was $13 million— Learn about the purpose of Series A, B and C funding, the difference between them, and how each impacts a business. The startup goes to a company that invests in startups (usually a venture capital firm, "VC", or sometimes just an individual with a lot of. Series E funding is the fifth major round of fundraising that a startup might go through. This round occurs late in the fundraising process, and usually takes. Venture round funding is a type of financing that is provided to early-stage companies, typically startups, in exchange for equity ownership. How is Series A Funding Structured? When a venture capital investor buys Series A preferred stock in the United States, it is the first round of preferred. After the pre-seed and seed round, series A financing is one of the funding rounds an early stage startup will encounter. By this point, the startup is showing. Stages of venture capital · 1. The seed stage · 2. The Series A stage · 3. The Series B stage · 4. The expansion stage (Series C and beyond) · 5. The mezzanine stage. These funds may be provided all at once, but more typically the capital is provided in rounds. The firm or investor then takes an active role in the funded. Essentially, the series A round is the second stage of startup financing and the first stage of venture capital financing. Similar to seed financing, series A. A Series B is a round of financing for a startup, typically led by venture capitalists or growth equity investors. These companies are more established, they. The series C round is the fourth stage of startup financing and typically the last stage of venture capital financing. However, some companies opt to conduct. The first round of institutional venture capital to fund growth is called the Series A round. Venture capitalists provide this financing in the interest of. Series C funding typically comes from venture capital firms that invest in late-stage startups, private equity firms, banks, and even hedge funds. Series D. Late stage funding. Series D, series E and series F rounds are late-stage VC funding. At this point, startup companies should be generating revenue and. In terms of process, series B is similar to series A, but the investors may be slightly different, with some venture capital firms specialising in later-stage. VCs assess the alignment between a startup's development stage and the associated risks to optimize the funding amount. This adequation is crucial, as it.