rutor-kek.ru

Gainers & Losers

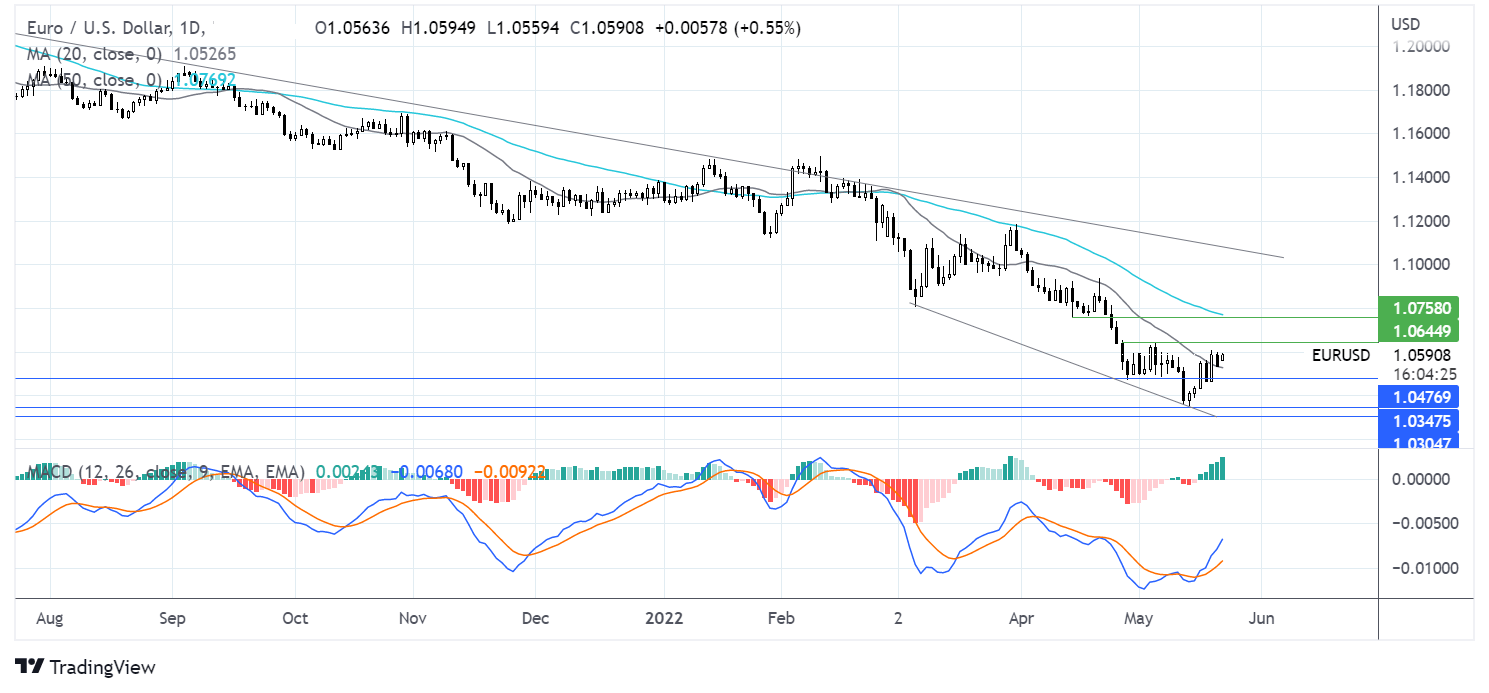

Forex Euro To Usd

+%. (1Y). Euro to US Dollar. 1 EUR = USD. Aug EUR/USD is a currency pair reflecting the current exchange rate of the euro (base currency) versus the US dollar (quote currency). The current rate of EURUSD is USD — it has increased by % in the past 24 hours. See more of EURUSD rate dynamics on the detailed chart. For example, if the pair is trading at , it means it takes U.S. dollars to buy 1 euro. Key Takeaways. The EUR/USD is the world's most-traded forex pair. EUR/USD Forex Trading Conditions ; Swap, pip (Long/Short), / , / , / ; Digits, , , rutor-kek.ru Euro Forecast: EUR/USD Fresh Yearly Highs as Overbought Readings Flash. 15 hours ago ; FXStreet. EUR/USD touches after Fed's Powell signals ready. EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its. Dive into historical exchange rates for EUR to USD with Wise's currency converter. Analyse past currency performance, track trends, and discover how. Check our updated for EUR USD News including real time updates, forecast, technical analysis and the economic latest events from the best source of Forex. +%. (1Y). Euro to US Dollar. 1 EUR = USD. Aug EUR/USD is a currency pair reflecting the current exchange rate of the euro (base currency) versus the US dollar (quote currency). The current rate of EURUSD is USD — it has increased by % in the past 24 hours. See more of EURUSD rate dynamics on the detailed chart. For example, if the pair is trading at , it means it takes U.S. dollars to buy 1 euro. Key Takeaways. The EUR/USD is the world's most-traded forex pair. EUR/USD Forex Trading Conditions ; Swap, pip (Long/Short), / , / , / ; Digits, , , rutor-kek.ru Euro Forecast: EUR/USD Fresh Yearly Highs as Overbought Readings Flash. 15 hours ago ; FXStreet. EUR/USD touches after Fed's Powell signals ready. EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its. Dive into historical exchange rates for EUR to USD with Wise's currency converter. Analyse past currency performance, track trends, and discover how. Check our updated for EUR USD News including real time updates, forecast, technical analysis and the economic latest events from the best source of Forex.

Convert Euro to US Dollar ; 1 EUR, USD ; 5 EUR, USD ; 10 EUR, USD ; 25 EUR, USD.

Euro to US Dollar Exchange Rate is at a current level of , down from the previous market day and up from one year ago. You will notice that the FX rate has ranged between and during that time period. That range is basically from near parity – almost a exchange. EUR/USD exchange rate. Charts, forecast poll, current trading positions and technical analysis. Keep informed on EUR/USD updates. Live Euro / US dollar chart. Plus all major currency pairs, realtime Indices Charts, Commodities Charts, Futures Charts and more. Current exchange rate EURO (EUR) to US DOLLAR (USD) including currency converter, buying & selling rate and historical conversion chart. Get Euro/US Dollar FX Spot Rate (EURUSD=X) real-time currency quotes, news, price and financial information from Reuters to inform your trading and. ECB euro reference exchange rate ; Min (3 October ). ; Max (22 August ). ; Average. 1 Euro = US Dollars as of August 25, AM UTC. You can get live exchange rates between Euros and US Dollars using rutor-kek.ru, which. Euros to US Dollars: exchange rates today ; 1 EUR, USD ; 10 EUR, USD ; 20 EUR, USD ; 50 EUR, USD. The Euro US Dollar Exchange Rate - EUR/USD is expected to trade at by the end of this quarter, according to Trading Economics global macro models and. Download Our Currency Converter App ; 1 EUR, USD ; 5 EUR, USD ; 10 EUR, USD ; 20 EUR, USD. USD/EUR. 4. 4 ; USD/JPY. 4. 9 ; JPY/USD. 2. 3 ; XAU/USD. 0. 0. CME listed FX futures offer more precise risk management of EUR/USD exposure through firm pricing, convenient futures and options, and trading flexibility. Live EUR/USD Exchange Rate Data, Calculator, Chart, Statistics, Volumes and History ; Today's High: ; Today's Low: ; Previous day's Close: This Free Currency Exchange Rates Calculator helps you convert Euro to US Dollar from any amount. See the latest trading price chart of EUR/USD. Buy and Sell the "Fiber" Forex currency pair CFDs on EURUSD. Get all information on the EUR/USD exchange rate including charts, historical data, news and realtime price. View live Euro / US Dollar chart to track. CD Rates · Best HYSA · Best Free Checking · Student Loans · Personal Loans · Insurance EUR=X USD/EUR. %. ETH-USD Ethereum USD. 2, %. EUR to USD | historical currency prices including date ranges Bonds & Rates · Currencies Market Data · Mutual Funds & ETFs · Opinion. Columnists.

What Are Target Date Index Funds

Target date funds are built for investors who expect to start gradual withdrawals of fund assets on the target date to begin covering expenses in retirement. A certain form of mutual fund called target date funds is designed to be a means of retirement planning. They are made to age with you by gradually rebalancing. Each of the Target Retirement Funds invests in Vanguard's broadest index funds, giving you access to thousands of U.S. and international stocks and bonds. Target date funds are professionally managed, diversified investment portfolios. Each portfolio consists of a mix of investments appropriate to its target date. Find the top rated Target-Date Retirement mutual funds. Compare reviews and ratings on Financial mutual funds from Morningstar, S&P, and others to help find. A diversified mutual fund that automatically shifts towards a more conservative mix of investments as it approaches a particular year in the future. Target date funds are designed to be long-term investments for individuals with particular retirement dates in mind. A good, low-cost target date fund (which is the kind you should use) is itself actually nothing more than a collection of index funds! Target date funds are designed for people who want to make exactly 1 decision about their investments and never want to revisit. They do an. Target date funds are built for investors who expect to start gradual withdrawals of fund assets on the target date to begin covering expenses in retirement. A certain form of mutual fund called target date funds is designed to be a means of retirement planning. They are made to age with you by gradually rebalancing. Each of the Target Retirement Funds invests in Vanguard's broadest index funds, giving you access to thousands of U.S. and international stocks and bonds. Target date funds are professionally managed, diversified investment portfolios. Each portfolio consists of a mix of investments appropriate to its target date. Find the top rated Target-Date Retirement mutual funds. Compare reviews and ratings on Financial mutual funds from Morningstar, S&P, and others to help find. A diversified mutual fund that automatically shifts towards a more conservative mix of investments as it approaches a particular year in the future. Target date funds are designed to be long-term investments for individuals with particular retirement dates in mind. A good, low-cost target date fund (which is the kind you should use) is itself actually nothing more than a collection of index funds! Target date funds are designed for people who want to make exactly 1 decision about their investments and never want to revisit. They do an.

Our target date funds seek to deliver consistent, long term results across a range of market cycles to help employees' investments work harder for the. Investments in American Funds target date funds are allocated among a diversified portfolio of stocks and bonds. Investors select a target date fund, typically. Voya's Target Date Blend Series are designed to specifically balance the evolving risk-return profiles of participants as they age to maximize the probability. Nuveen Lifecycle Index Fund is an all-in-one investment option that offer a completely diversified portfolio with asset allocations that are geared toward the. A target date fund is an age-based retirement investment that helps you take more risk when you're young and gets more conservative over time. Discover how. A target date fund is a type of mutual fund structured to make it easier for investors to maintain a desirable asset allocation over time. Target Date Funds have a mandate to grow assets over a specified period of time to reach a targeted goal. These funds employ a strategy where asset. How Target-Date Funds Work. Target-date funds typically are structured as a mutual fund. The particular investments a mutual fund makes are determined by its. Target date funds are built for investors who expect to start gradual withdrawals of fund assets on the target date, to begin covering expenses in retirement. Target-date funds take asset allocation and investment selection wholly out of investors' hands—not just at a single point in time but at least until. Lifecycle target date funds are age-based retirement investments that are designed to provide investment solutions. Learn how to start a target date fund. A target date fund's (TDF) glide path is typically set to align with a retirement age of 65, which may be your plan's normal retirement date (NRD). If your. Each Target Retirement Fund invests in several other Vanguard funds to create a broadly diversified mix of stocks, bonds, and, in some cases, short-term. Our pick for the best target-date fund goes to VFIFX. Despite requiring a $1, minimum investment, this fund has a low expense ratio of %, or just $8. Portfolios are made up of underlying funds and those funds can be either actively managed or passive funds, such as ETFs or index funds, or a combination of. Target date funds are an asset mix of stocks, bonds and other investments that automatically becomes more conservative as the fund approaches its target. Target date funds are groups of funds, where each fund in the series targets a different mix of stocks and bonds for investors with different retirement time. The S&P Target Date To Retirement Income Index is designed to represent a market consensus of asset class exposure and glide path across the universe of "to". Here, we're referring to the State Street Target Retirement Funds (“Target Date Funds”), a current investment Global All Cap Equity ex-US Index Fund. Target-date funds offer a set-it-and-forget-it investment vehicle, while index funds include a basket of investments tied to an index. Read on.

Poa Crypto

A blockchain consensus mechanism that delivers comparatively fast transactions using identity as a stake. Swap POA Network on Swapzone crypto exchange aggregator. Compare the POA Network exchange rates, choose a service by rates, rating, or transaction speed. Proof of authority (PoA) is an algorithm used with blockchains that delivers comparatively fast transactions through a consensus mechanism based on identity. Stay updated with the latest poa-network token price, charts, and market trends. Dive deep into comprehensive cryptocurrency news and insights on our. Create a Bitbuy account to buy and sell crypto on Canada's leading exchange. Trade. Conversion Calculator. POA (POA). CAD. The POA Network Sidechain Solution. The POA Network was designed as a clone of Ethereum and was meant to be its own public blockchain. This means it isn't. A variant of the Proof of Stake (PoS) consensus mechanism, Proof of Authority (PoA) selects its validators based on reputation. blockchain. The chain has to be signed off by the majority of PoA deployments are used by the enterprise and by the public (e.g. popular. This guide outlines proof-of-authority vs. proof-of-stake differences. You will find that the PoA consensus relies on identity rather than digital assets. A blockchain consensus mechanism that delivers comparatively fast transactions using identity as a stake. Swap POA Network on Swapzone crypto exchange aggregator. Compare the POA Network exchange rates, choose a service by rates, rating, or transaction speed. Proof of authority (PoA) is an algorithm used with blockchains that delivers comparatively fast transactions through a consensus mechanism based on identity. Stay updated with the latest poa-network token price, charts, and market trends. Dive deep into comprehensive cryptocurrency news and insights on our. Create a Bitbuy account to buy and sell crypto on Canada's leading exchange. Trade. Conversion Calculator. POA (POA). CAD. The POA Network Sidechain Solution. The POA Network was designed as a clone of Ethereum and was meant to be its own public blockchain. This means it isn't. A variant of the Proof of Stake (PoS) consensus mechanism, Proof of Authority (PoA) selects its validators based on reputation. blockchain. The chain has to be signed off by the majority of PoA deployments are used by the enterprise and by the public (e.g. popular. This guide outlines proof-of-authority vs. proof-of-stake differences. You will find that the PoA consensus relies on identity rather than digital assets.

View POA Network (POA) cryptocurrency prices and market charts. Stay informed on how much POA Network is worth and evaluate current and historical price. POA Network USD Price Today - discover how much 1 POA is worth in USD with converter, price chart, market cap, trade volume, historical data and more. POA Network (POA) is a digital asset with the market capitalization of $M. POA Network is ranged as in the global cryptocurrency rating with an. Blockchain networks and cryptocurrencies have to validate their new data blocks against data from many different validation nodes. The Proof-Of-Authority (PoA) is a consensus method that gives a small and designated number of blockchain actors the power to validate transactions or. POA (POA) is a cryptocurrency that allows users to earn POA rewards by confirming blockchain transactions, which is known as mining. The current market. POA Network (POA) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. POA - STAKE swaps nearing 15% of POA supply. Over 43M POA swapped and + unique swappers. Swap will be open for the poa-crypto/ Quote. 7b · @7bbroker. ·. As the crypto industry continues to evolve, POA Network is poised to play a significant role in shaping the future of decentralized applications and blockchain. POA Network is an open Ethereum sidechain with Proof of Authority consensus, reached by independent validators. We are building a public network for smart. Learn more about POA network, collaboration with 7B, and how to trade $POA token on their platform here rutor-kek.ru Proof of Authority (PoA) is a consensus mechanism used in permissioned networks, where a small group of trusted authorities are selected as transaction. The current real time POA Network price is $, and its trading volume is $0 in the last 24 hours. POA price has grew by % in the last day, and. Easily convert POA Network to US Dollar with our cryptocurrency converter. 1 POA is currently worth $ At each time interval, the leader role is passed to the next validating node from the list of validating nodes. PoA allows every selected. What is proof of authority (POA)? The term was coined by Ethereum co-founder Gavin Wood in Proof of authority definition in cryptocurrencies refers to an. Cryptocurrency ethereum (ETH-USD) is getting the slightest bump higher Tuesday morning after spot ether ETFs begin trading. The Securities and Exchange. An open network based on Ethereum protocol with Proof of Authority consensus by independent actors. Public notaries with known identity serve as private. The live price of POA Network is $ per (POA / USD) with a current market cap of $ 0 USD. hour trading volume is $ 0 USD. POA to USD price is updated. $ · Top POA Markets · Overview · Cryptocurrencies on Markets are sorted by market capitalization by default, but they can also be sorted by other factors such.

Will The Market Be Up Tomorrow

Markets. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. * Nasdaq will continue to send alerts to notify customers of days when the Market will close early. Email Sign-Up · © Copyright · Disclaimer · Trademarks. Find the latest stock market news from every corner of the globe at rutor-kek.ru, your online source for breaking international market and finance news. Stock Market Crash: Find out why Stock Market crashed today? Get the latest market share, they will be ready to price the products out there. The. I would like to receive updates and special offers from Dow Jones and affiliates, including recommended content or information on upcoming events. Stock purchases or sales can be scheduled 24/7. However, orders will only be placed when the U.S. market is open for trading. The U.S. stock market is generally. Shares are up +% in late trading. Fast-casual Mediterranean-style restaurant CAVA Group CAVA are seeing share rise more than +6% following its Q2 earnings. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. Get the latest news on the stock market and events that move stocks, with in-depth analyses to help you make investing and trading decisions. Markets. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. * Nasdaq will continue to send alerts to notify customers of days when the Market will close early. Email Sign-Up · © Copyright · Disclaimer · Trademarks. Find the latest stock market news from every corner of the globe at rutor-kek.ru, your online source for breaking international market and finance news. Stock Market Crash: Find out why Stock Market crashed today? Get the latest market share, they will be ready to price the products out there. The. I would like to receive updates and special offers from Dow Jones and affiliates, including recommended content or information on upcoming events. Stock purchases or sales can be scheduled 24/7. However, orders will only be placed when the U.S. market is open for trading. The U.S. stock market is generally. Shares are up +% in late trading. Fast-casual Mediterranean-style restaurant CAVA Group CAVA are seeing share rise more than +6% following its Q2 earnings. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. Get the latest news on the stock market and events that move stocks, with in-depth analyses to help you make investing and trading decisions.

Market tone was positive on the week driven by signs that inflation is trending lower which means the Fed is directionally closer to start easing. Use this calendar to keep up with all the stock market holidays. Even Wall Street takes days off. The regular schedule for the New York Stock Exchange. The global stock market is composed of stock exchanges around the world. Most of them are open to trade Monday through Friday during regular business hours. Most stock markets around the world will be open for trading from Monday to Friday, and will be closed on the weekends. Some stock exchanges such as a. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. I'm unhappy when the market goes up because I feel I "missed" the chance to buy at lower prices companies on my watchlist. The bigger the sum in my investment. market hours; after-hours trading was reserved for institutional investors. However, today's markets are more open than ever, and individuals are free to. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. Up next · Powell delivers 'cathartic' speech, investment manager says · Market Insight: 'Equilibrium rate' could be closer than investors think · Market Insight. The NYSE and NASDAQ are open Monday-Friday and closed on Saturday and Sunday. In some countries, the stock market is open on Saturday or Sunday in some cases. 1 The NYSE will close early ( p.m. Eastern time) on the day before Independence Day. 2 The Standard will be closed and the NYSE will close early ( Where the stock market will trade today based on Dow Jones Industrial Average, S&P and Nasdaq futures and implied open premarket values. The Fed Says It Will Cut Interest Rates. Markets Shrug. Here's Why Sign up for Europe Daily newsletter. Get top headlines impacting European. "I would also like to thank you so much for the excellent Cycle Analysis that you provide! My retirement account is up substantially over the past 2 months! (Friday market open) Stocks attempted a recovery early Friday from yesterday's sharp. Tomorrow; This Week; Next Week. No Events Scheduled. Show More. INVEST IN S&P ends up, win streak at 5; Nasdaq ekes out gain. S&P ends up. Want to offer some commentary on markets? Maybe you would just like to throw out a neat fact that doesn't warrant a self post? Feel free to post here! If your. Stocks Are Dropping on Weak Manufacturing Numbers. It's Up to Powell to Save the Market. Aug. 22, a.m. ET. There's a Good Case for. Trading Plan: Will Bank Nifty continue to outperform benchmark Nifty 50? The Nifty 50 is likely to inch towards the 24,, zone in the coming sessions. US open: Stocks higher following Powell's Jackson Hole speech. Fri 23 Under the new price cap, the average annual energy bill will ri; Thursday.

Best App For Investing In Index Funds

Robinhood was the first app to offer completely commission free investing. It offers free stock, ETF, options, and cryptocurrency trades. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Wealthsimple: Best for beginners · Questrade: Best for ETFs · Moka: Best for S&P investing · Qtrade: Best for ease-of-use · Wealthsimple Trade: Best for free trades. An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the. You have to get out of the mind set of “trading” and into the mind set of investing. You also have to focus on cutting expenses and matching stock market. Stocks, ETFs and high interest with zero commissions and powerful automation. Start building wealth today! The IFA app, from Index Fund Advisors, is an educational resource for investors. Index Fund Advisors provides personalized fiduciary wealth services. ET Money, the trusted choice of millions of investors across India for investment in Direct Mutual Funds, NPS, Fixed Deposit & ET Money Genius. Best investing apps · Best app for automated investing: Betterment · Best app for micro-investing: Acorns · Best app for active investing: Robinhood · Best app for. Robinhood was the first app to offer completely commission free investing. It offers free stock, ETF, options, and cryptocurrency trades. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Wealthsimple: Best for beginners · Questrade: Best for ETFs · Moka: Best for S&P investing · Qtrade: Best for ease-of-use · Wealthsimple Trade: Best for free trades. An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the. You have to get out of the mind set of “trading” and into the mind set of investing. You also have to focus on cutting expenses and matching stock market. Stocks, ETFs and high interest with zero commissions and powerful automation. Start building wealth today! The IFA app, from Index Fund Advisors, is an educational resource for investors. Index Fund Advisors provides personalized fiduciary wealth services. ET Money, the trusted choice of millions of investors across India for investment in Direct Mutual Funds, NPS, Fixed Deposit & ET Money Genius. Best investing apps · Best app for automated investing: Betterment · Best app for micro-investing: Acorns · Best app for active investing: Robinhood · Best app for.

Since , Schwab has provided clients with new ways to access efficient, cost-effective, index-based investments. See below how Schwab index mutual funds. Hargreaves Lansdown: Best online broker for UK index funds · Interactive Investor: Fixed-fee index fund investing · AJ Bell: Best for low-cost index fund. Fidelity, Schwab, or Vanguard are great options. I have fidelity and it is a great and easy app to use and invest with. Betterment – Best app for automated investing · Invstr – Best app for education · Acorns – Best app for saving · Wealthfront – Best app for portfolio management. Robinhood offers commission-free trading for stocks, options, ETFs, and cryptocurrencies, making it a popular choice for those starting out in. Best investing apps · Best app for automated investing: Betterment · Best app for micro-investing: Acorns · Best app for active investing: Robinhood · Best app for. Index funds: This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively. Quick Look at the Best Online Brokers for Index Funds: · Best for Low Fees: Interactive Brokers · Best for Well-Funded Investors: Frec · Best for Retirement Saving. Index funds are a type of mutual fund portfolio, where your money gets pooled together with other investors in stocks, bonds and more. Theyre passively managed. Also, consider using a robo-advisor like Wealthfront and Betterment (which Select rated highly on our list of the best robo-advisors), which will invest in a. Are Index Funds Good Investments? As Knutson noted, index funds are very popular among investors because they offer a simple, no-fuss way to gain exposure to. E*TRADE, Wealthfront, Interactive Brokers, Webull, Fidelity, and Acorns are the best investment apps based on user experience, trading technology, fees. Our Favourite Investment Apps · Hatch: Best App or Platform for New Zealanders Growing their Portfolio while Learning About Investing · Tiger Brokers (NZ): Best. List of Best Index Funds in India sorted by Returns ; Bandhan Nifty 50 Index Fund · ₹1, Crs ; UTI Nifty 50 Index Fund · ₹19, Crs ; ICICI Prudential Nifty Our mutual funds are managed by experts who choose and monitor the stocks or bonds the funds invest in, saving you time and effort. Learn more about investing. The Vanguard mobile investing app empowers you to stay on top of your investments. Download the app to start investing, trading, monitoring accounts. Fidelity stock and bond index mutual funds and sector ETFs have lower expenses than all comparable funds at Vanguard Open an Account. CNBC Select asked Brian Stivers of Stivers Financial Services to help us crunch the numbers. · Wealthfront · Betterment · Charles Schwab · Fidelity Investments. rutor-kek.ru offers a set of financial tools covering a wide variety of global and local financial instruments. A one-stop-shop for traders and investors. An Index Fund is a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of an underlying index such as Nifty 50 Index, Nifty.

Chaikin Money Flow Index

The Chaikin Money Flow Index (CMF) is a volume-weighted average of accumulation and distribution over a specified period. CMF. Analyzing the accumulation and distribution of stocks, the Chaikin Money Flow indicator, developed by Marc Chaikin in the s, quantifies money flow volume. The money flow index (MFI) is quite different than the Chaiken money flow oscillator because it uses volume in combination with recent price movements. Money Flow Oscillators · Accumulation/Distribution Indicator (A/D) · Chaikin Money Flow (CMF) · Chaikin Oscillator · Ease of Movement Indicator · Elder's Force Index. The Chaikin Money Flow is a principal that states that the nearer the closing price is to the high, the more accumulation has taken place. The formula for Chaikin Money Flow is the cumulative total of the Accumulation/Distribution Values for 21 periods divided by the cumulative total of volume for. The Chaikin Money Flow indicator is predominantly used as a tool to help gauge the strength of a trend. It is not a trading system designed to provide stop-loss. How does the Chaikin Money Flow indicator work? It signals traders to place buy orders whenever the currency pair price levels approach the overbought level but. Chaikin Money Flow (CMF) is a technical analysis indicator used to measure Money Flow Volume over a set period of time. The Chaikin Money Flow Index (CMF) is a volume-weighted average of accumulation and distribution over a specified period. CMF. Analyzing the accumulation and distribution of stocks, the Chaikin Money Flow indicator, developed by Marc Chaikin in the s, quantifies money flow volume. The money flow index (MFI) is quite different than the Chaiken money flow oscillator because it uses volume in combination with recent price movements. Money Flow Oscillators · Accumulation/Distribution Indicator (A/D) · Chaikin Money Flow (CMF) · Chaikin Oscillator · Ease of Movement Indicator · Elder's Force Index. The Chaikin Money Flow is a principal that states that the nearer the closing price is to the high, the more accumulation has taken place. The formula for Chaikin Money Flow is the cumulative total of the Accumulation/Distribution Values for 21 periods divided by the cumulative total of volume for. The Chaikin Money Flow indicator is predominantly used as a tool to help gauge the strength of a trend. It is not a trading system designed to provide stop-loss. How does the Chaikin Money Flow indicator work? It signals traders to place buy orders whenever the currency pair price levels approach the overbought level but. Chaikin Money Flow (CMF) is a technical analysis indicator used to measure Money Flow Volume over a set period of time.

This indicator known as CMF is related to the Accumulation / Distribution line which was also created by Marc Chaikin. Both are used to show the flow of money. On-balance volume (Obv), Chaikin money flow (Cmf), accumulation/distribution, volume price trend (Vpt), volume oscillator (VO), ease of movement, negative. Chaikin Money Flow. Chaikin Money Flow (CMF) is another indicator developed by Marc Chaikin, a stockbroker since The idea behind CMF indicator lies in. Money Flow Index is an oscillator which combines price and volume to indicate trends and reversals. Values above 80 could indicate that the stock is overbought. Chaikin money flow (CMF), developed by renowned stock analyst Marc Chaikin, is a technical indicator used to assess the flow of money into or out of a security. Chaikin Money Flow looks “inside” a stock's trading activity to distinguish price movements which are likely to be supportable based on price/volume patterns. On the other hand, the Chaikin Money Flow (CMF) is calculated by comparing the closing price of an asset to its high and low prices while incorporating volume. Help articles for TC software, EasyScan stock & option screener, charting, trading functions, technical indicators, company fundamentals, formula writing. On the other hand, the Chaikin Money Flow (CMF) is calculated by comparing the closing price of an asset to its high and low prices while incorporating volume. Chaikin Money Flow (CMF) is a technical indicator that measures an asset's buying and selling pressure in financial markets. It was developed by Marc Chaikin. The Chaikin Money Flow (CMF) is a technical analysis indicator developed by Marc Chaikin to measure money flow into and out of an asset over a specified period. The Chaikin Money Flow oscillator is calculated by default as a cumulative total of the Accumulation/Distribution Values divided by the total volume for the. Chaikin Money Flow (CMF) is a technical analysis indicator used to measure Money Flow Volume over a set period of time. Money Flow Volume (a concept also. Colin Twiggs' Money Flow indicator is similar to the Chaikin Money Flow (CMF). Where Chaikin Money Flow uses CLV (Close Location Value) to to evaluate. Money Flow Oscillators · Accumulation/Distribution Indicator (A/D) · Chaikin Money Flow (CMF) · Chaikin Oscillator · Ease of Movement Indicator · Elder's Force Index. The Chaikin Money Flow indicator compares the closing price to the high-low range of the trading session. if the instrument' price closes near the high of the. Chaikin Money Flow is an indicator measuring Money Flow (Volume x Price) over selected period of time. The CMF indicator uses CLV to define whether volume. Market Synopsis. The Chaikin Money Flow calculation is based on Accumulation/Distribution over a specified period divided by the sum of volume for the same. Like other momentum indicators, this indicator is designed to anticipate directional changes in the Accumulation Distribution Line by measuring the momentum. Chaikin Money Flow measures the amount of Money Flow Volume over a specific period. Money Flow Volume forms the basis for the Accumulation Distribution Line.

Return On Investment In Real Estate

Average ROI on Real Estate. The average annual return over the past two decades from residential and commercial real estate is approximately 10%.. The biggest mistake people make when investing in Real Estate is focusing too much on one or two of the three factors that affect your ROI (return on. There isn't a set standard for what makes a good ROI in real estate. It depends on several factors, including property type, interest rates, real estate. You need to realize that to really earn money on an investment property, you need to hold that asset for as long as you can. You won't see a profit in the first. How To Make Money From Investing In Real Estate · Real estate investments generate income through rent – Some people invest in properties such as buildings. Despite there being many ways to determine a property's ROI, calculating the ROI can be as simple as using a fairly standardized formula. The ROI of a property. Most deals I am underwriting at % IRR. Leveraged Cash on cash is generally lower at around % depending on a lot of factors. For calculating the return on investment percentage, consider the net profit made on the investment and then divide that amount with the original cost. ROI. A return on investment (ROI) for real estate can vary greatly depending on how the property is financed, the rental income, and the costs involved. Average ROI on Real Estate. The average annual return over the past two decades from residential and commercial real estate is approximately 10%.. The biggest mistake people make when investing in Real Estate is focusing too much on one or two of the three factors that affect your ROI (return on. There isn't a set standard for what makes a good ROI in real estate. It depends on several factors, including property type, interest rates, real estate. You need to realize that to really earn money on an investment property, you need to hold that asset for as long as you can. You won't see a profit in the first. How To Make Money From Investing In Real Estate · Real estate investments generate income through rent – Some people invest in properties such as buildings. Despite there being many ways to determine a property's ROI, calculating the ROI can be as simple as using a fairly standardized formula. The ROI of a property. Most deals I am underwriting at % IRR. Leveraged Cash on cash is generally lower at around % depending on a lot of factors. For calculating the return on investment percentage, consider the net profit made on the investment and then divide that amount with the original cost. ROI. A return on investment (ROI) for real estate can vary greatly depending on how the property is financed, the rental income, and the costs involved.

We are a full-service real estate brokerage firm focused on commercial and residential properties, fiduciary services, and judicial appointments. Total returns paint the entire picture of a real estate investment. They will factor in cash flows from the project, the appreciation, the loan paydown, and the. However, the average annual ROI for residential real estate is presently around 10%, so anything above that is better than average. How to Calculate Long-Term. Cities where real estate earns the highest yield, and property investing is most profitable. Returns on residential investments in primary cities around the. Takeaways · ROI in real estate is a metric used by investors to predict the profitability of a property investment. · Calculate ROI by dividing the difference. How to Calculate ROI on Rental Property · Purchase price = $, · Down payment = $25, · Sale price = $, · Gain on sale = $35, · Mortgage expense. ROI= (Proceeds from Investment – Cost of Investment)/Cost of Investment · Calculate the expected annual rental income · Subtract rental expenses from annual. Average ROI on Real Estate. The average annual return over the past two decades from residential and commercial real estate is approximately 10%.. ▶️ What is a good ROI in real estate? A good ROI in real estate typically ranges from 8% to 12%, though it can vary based on the market and. The biggest mistake people make when investing in Real Estate is focusing too much on one or two of the three factors that affect your ROI (return on. But if you want to know the average annualized returns of long-term real estate investments, it's %. That's about the same as what the stock market returns. Typically, rental yield, which is annual rental income expressed as a percentage of the property's value, ranges between 3% to 5% for residential properties. $ monthly cash flow may seem like a small amount, but cash on cash return alone (just by collecting rent and paying down the mortgage) would allow you to. 1. Net Operating Income (NOI) · 2. Capitalization Rate (Cap Rate) · 3. Internal Rate of Return (IRR) · 4. Cash Flow · 5. Cash on Cash Return · 6. Gross Rent. Return on investment (ROI) is the expected profits from a rental property, as a percentage. To solve for ROI, take the estimated annual rate of return, divide. Purchase price, loan terms, appreciation rate, taxes, expenses and other factors must be considered when you evaluate a real estate investment. Use this. An ROI calculation simply looks at how much a property costs, and how much money it makes, allowing you to see it as a percentage of profit or loss. Monthly. Real estate investing involves the purchase, management and sale or rental of real estate for profit. Someone who actively or passively invests in real. Our real estate return on investment calculator estimates your ROI for a real estate purchase. real estate return on investment, ROI, real estate. Two Ways to Calculate Your ROI. There are two ways to calculate the return on investment on a real estate flip. The first way is to take the total value of the.

Stock Investment Manager

A global asset management firm delivering on strategy for institutions, financial advisors, and investors worldwide. Investment managers handle assets for others for a fee or a commission. Included within the sector are fund and trust managers, as well as other investment. BlackRock is one of the world's preeminent asset management firms and a premier provider of investment management. Find out more information here. Portfolio managers are investment decision-makers. They devise and implement investment strategies and processes to meet client goals and constraints. Investment Account Manager offers tools to help people better understand and manage portfolios for stocks, bonds, mutual funds, exchange traded funds. PanAgora Asset Management is a quantitative investment manager of distinct and innovative Equity, Multi Asset and Risk Premia strategies. Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate. Nuveen is a global investment manager working in partnership with clients to create outcome-focused solutions to help reach their goals for the financial. Stock brokers are experts in trading. They research the latest investment opportunities and stay on top of the market cycles, bringing on new portfolios and. A global asset management firm delivering on strategy for institutions, financial advisors, and investors worldwide. Investment managers handle assets for others for a fee or a commission. Included within the sector are fund and trust managers, as well as other investment. BlackRock is one of the world's preeminent asset management firms and a premier provider of investment management. Find out more information here. Portfolio managers are investment decision-makers. They devise and implement investment strategies and processes to meet client goals and constraints. Investment Account Manager offers tools to help people better understand and manage portfolios for stocks, bonds, mutual funds, exchange traded funds. PanAgora Asset Management is a quantitative investment manager of distinct and innovative Equity, Multi Asset and Risk Premia strategies. Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate. Nuveen is a global investment manager working in partnership with clients to create outcome-focused solutions to help reach their goals for the financial. Stock brokers are experts in trading. They research the latest investment opportunities and stay on top of the market cycles, bringing on new portfolios and.

Balanced fund - Mutual funds that seek both growth and income in a portfolio with a mix of common stock, preferred stock or bonds. The companies selected. Since , Harris Associates has managed money for individuals, institutions, and private equity clients with consistent investment philosophies and. Investment management, also known as asset management or portfolio management, is the professional management of various securities (such as stocks and bonds). BlackRock is one of the world's preeminent asset management firms and a premier provider of investment management. Find out more information here. Investment Account Manager offers tools to help people better understand and manage portfolios for stocks, bonds, mutual funds, exchange traded funds. Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate. Eaton Vance is part of Morgan Stanley Investment Management, the asset management division of Morgan Stanley. For USA PATRIOT Act Disclosure Notice please click. An investment manager is a specialized financial professional responsible for making informed decisions about allocating and managing assets on behalf of. Portfolio managers are professionals who manage investment portfolios, with the goal of achieving their clients' investment objectives. Brookfield Asset Management is a leading global alternative asset manager across renewable power and transition, infrastructure, private equity. Our integrated offerings across equity, fixed income, and multi-asset solutions are designed to see challenges from many angles and help investors achieve. Our asset class experience runs deep. There's no shortage of proactive thinking and responsiveness from your highly accessible portfolio managers who help. If you are an individual retirement investor, contact your financial advisor or other fiduciary unrelated to PIMCO about whether any given investment idea. State Street provides investment servicing, investment management, investment research and trading services to institutional investors worldwide. As a responsible asset manager, our purpose is to act for human progress by investing for what matters. We believe in sustainability and innovation. Shares of the Trusts are not subject to the same regulatory requirements as mutual funds. As a result, shareholders of the Trusts do not have the protections. Invest. Delivering asset management, capital markets and insurance solutions to our clients and partners around the world. Learn More · Private Equity. We are a leading global investment firm, investing on behalf of institutions and individuals around the world. WCM Investment Management provides innovative, growth equity investment advisory services. Our firm focuses on fundamental, original equity research as the. Jensen Investment Management is a high-conviction, active equity manager with an unwavering commitment to quality.

Best Starting Out Credit Cards

One of the best ways to start building your credit history is to apply for a credit card. Credit cards give you the ability to charge your purchases, rather. The Capital One Secured card is good for those who are okay with a lower credit limit. Annual fee, $0. APR, % Variable. Security deposit, $49, $99 or $ How to get your first credit card: 5 tips · 1. Check credit scores and credit reports · 2. Consider beginner credit cards · 3. Explore rewards credit card options. The First Tech Platinum Secured Mastercard card is a great choice if you are building credit. Your credit limit is secured by a refundable security deposit. The Huntington Cashback Credit Card lets you earn % unlimited cash back on every purchase in store, online, and everywhere in between. A secured credit card may be your best first credit card option if you have no credit history or even bad credit. By coming up with a refundable deposit. The Secured Mastercard from Capital One is a good first credit card to build credit as it comes with no annual fees or foreign transaction fees. The starting. Best secured credit cards for September · + Show Summary · Capital One Platinum Secured Credit Card · Chime Credit Builder Secured Visa® Credit Card. The best credit cards for applicants with no credit are secured credit cards and student credit cards. Secured credit cards have lower credit requirements. One of the best ways to start building your credit history is to apply for a credit card. Credit cards give you the ability to charge your purchases, rather. The Capital One Secured card is good for those who are okay with a lower credit limit. Annual fee, $0. APR, % Variable. Security deposit, $49, $99 or $ How to get your first credit card: 5 tips · 1. Check credit scores and credit reports · 2. Consider beginner credit cards · 3. Explore rewards credit card options. The First Tech Platinum Secured Mastercard card is a great choice if you are building credit. Your credit limit is secured by a refundable security deposit. The Huntington Cashback Credit Card lets you earn % unlimited cash back on every purchase in store, online, and everywhere in between. A secured credit card may be your best first credit card option if you have no credit history or even bad credit. By coming up with a refundable deposit. The Secured Mastercard from Capital One is a good first credit card to build credit as it comes with no annual fees or foreign transaction fees. The starting. Best secured credit cards for September · + Show Summary · Capital One Platinum Secured Credit Card · Chime Credit Builder Secured Visa® Credit Card. The best credit cards for applicants with no credit are secured credit cards and student credit cards. Secured credit cards have lower credit requirements.

Visa Credit Cards ; Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR. 0% intro APR for 12 months. 10 Top Credit Cards. Best credit card for bad credit. Discover it Secured Credit Card. Rates & Fees. The Capital One Secured card is good for those who are okay with a lower credit limit. Annual fee, $0. APR, % Variable. Security deposit, $49, $99 or $ Credit Cards for Excellent Credit · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Custom Cash® Card. Citi® Secured Mastercard®: This card lets you track your progress as you build credit with access to a free FICO score. Check out our review of Citi® Secured. Apply once for your best offer across all three Petal cards. Interface is easy to use and intuitive, all the info provided is very clear, they were my first. Platinum Credit Cards. Receive an introductory low APR* on all purchases and balance transfers for your first 12 billing cycles. Contactless solid gray MidFirst. 1. Check credit scores and credit reports · 2. Consider beginner credit cards · 3. Explore rewards credit card options · 4. Consider pre-approval · 5. Apply for. The U.S. Bank Secured Visa® credit card is perfect for a first-time credit card to start building credit or rebuilding credit. Learn more and apply today. Find the card that best fits your needs. PLUS, all cards have $0 Annual Fee! Get cash back. $ Million paid to members in ! Earn up to 4% cash back. great extra perks with your card once you build up a good credit score. As you can see, there are plenty of excellent benefits to opening a credit card. Get up to a $15, credit limit on an unsecured credit card. As a newcomer, choose from a variety of credit cards and start Building good credit could. For transferrable rewards, the Capital One Venture X is tops; for travel perks, we like the Amex Platinum Card®; and for the best starter travel card, go for. Which card is best for building credit? If you're simply new to the world of credit or are trying to expand your credit history, consider applying for a credit. Learn how to get your first credit account and build a credit history that is reported on a credit report. Credit can help you get a loan, credit card, job. To help people new to credit cards, issuers have created starter cards, which includes student credit cards. The primary difference between a starter card and a. The card reports to all three credit bureaus, which can help in building a better credit history. Note that there's an initial program fee for opening an. Best first-time credit cards - September ; Barclaycard Forward Credit Card - Check eligibility, %, £50 - £1,, £3, ; Capital One Classic Credit. When you first open the Petal 2 Visa Credit Card, you get 1% cash back on eligible purchases right away. Your cash back then increases up to % after making. What is Credit and Why is it Important: A Beginner's Guide to Credit. Good credit can work in your favor, whether you are applying for a loan or credit card.

Is It Worth Investing In Penny Stocks

Penny Stock Screener ; IVP. Inspire Veterinary Partners, Inc. Class A. $ $ (%). Pre. % ; MRNJ. Metatron. $ (50%) ; BLNK. Blink. Penny stocks are shares of small companies that trade at low prices. These stocks are an investment alternative that offers investors an excellent. Penny stocks are typically issued by small companies and cost less than $5 per share. They can garner interest from some investors who want to get in close. Penny stocks are shares of small companies that trade at low prices. These stocks are an investment alternative that offers investors an excellent opportunity. Penny Stocks App for android is use to find hot penny stocks ideas and top penny stocks today. Penny Stock Screener allows a trader to find daily top penny. Most Active Penny Stocks · ALST · AllStar Health Brands / AllStar Global Brands Sign Enzo Concina Pro Scout and Senior Italian Consultant · TNXP · Tonix Pharma. Most popular penny stocks end up diluting shareholders to zero. This is because they raise money using the stock, but their business plan is. Investing in penny stocks can be a great way to diversify your portfolio and potentially earn high returns. It is always important to do your own research and. Penny stocks are not traded on a stock exchange but are traded in the over-the-counter (OTC) market. Part of the OTC market is the NASDAQ National Market (NNM). Penny Stock Screener ; IVP. Inspire Veterinary Partners, Inc. Class A. $ $ (%). Pre. % ; MRNJ. Metatron. $ (50%) ; BLNK. Blink. Penny stocks are shares of small companies that trade at low prices. These stocks are an investment alternative that offers investors an excellent. Penny stocks are typically issued by small companies and cost less than $5 per share. They can garner interest from some investors who want to get in close. Penny stocks are shares of small companies that trade at low prices. These stocks are an investment alternative that offers investors an excellent opportunity. Penny Stocks App for android is use to find hot penny stocks ideas and top penny stocks today. Penny Stock Screener allows a trader to find daily top penny. Most Active Penny Stocks · ALST · AllStar Health Brands / AllStar Global Brands Sign Enzo Concina Pro Scout and Senior Italian Consultant · TNXP · Tonix Pharma. Most popular penny stocks end up diluting shareholders to zero. This is because they raise money using the stock, but their business plan is. Investing in penny stocks can be a great way to diversify your portfolio and potentially earn high returns. It is always important to do your own research and. Penny stocks are not traded on a stock exchange but are traded in the over-the-counter (OTC) market. Part of the OTC market is the NASDAQ National Market (NNM).

Learn about the risks of penny stocks and speculative stock investments and how this market works. Penny stocks can be profitable for investors, but they are also risky. They are not frequently traded stocks and often sudden bouts of market volatility. Warm reminder: Because of the high risk, if it is your first time to trade penny stocks, you need to confirm the risk disclosure before you can trade them. 2. Understanding how to trade penny stocks is crucial in these markets. The act of investing in penny stocks happens less-so as these shares are held for a shorter. Best penny stocks · iQIYI Inc. (IQ) · Geron Corp. (GERN) · rutor-kek.ru (TBLA) · Archer Aviation Inc. (ACHR) · Navitas Semiconductor Corp. (NVTS) · Nuvation Bio Inc.. In reality, they may be company insiders or paid promoters who stand to gain by selling their shares after the stock price is pumped up by the buying frenzy. If you've done your research and feel comfortable with the level of risk involved in your investment, then a penny stock might make sense for you. And given. Investing in penny stocks Penny stocks, the name sounds enticing, doesn't it? Small investment in hopes of a big return. But the truth is, the high volatility. -Penny stocks are low-priced shares of small companies not traded on an exchange or quoted on NASDAQ. Prices often are not available. Investors in penny stocks. For people who are very seasoned investors, and those who truly have the money to risk, penny stocks might be an option worth considering. But even most. The flip side is also true: if it does poorly, you could lose your money fast. Small-cap companies: Penny stocks have a small market capitalization or stock. penny stocks are typically not a good idea. 2. penny stocks can be stocks sold each to even $ each not necessarily pennies. 3. also if you want. Penny Stocks App for android is use to find hot penny stocks ideas and top penny stocks today. Penny Stock Screener allows a trader to find daily top penny. U.S. SEC Definition of Penny Stocks · Shares issued by a small company that are traded at a price below $5 per share. · Shares are usually traded over-the-counter. Buying the right penny stock at the right time can lead to a huge windfall, but the odds of seeing returns in the hundreds or even thousands of percent are. What are penny stocks? Penny stocks or penny shares are a common stock that trade for less than £1 on UK stock exchanges or less than $5 on US stock exchanges. This page provides a list of penny stocks (those trading between and ) sorted by the highest 5-day percent change. These high-volatility stocks. Due to their potential for rapid change, these investments can be both lucrative and high-risk. Penny stocks that pass the proper analysis can quickly multiply. Investing in penny stocks can be worth it if the investor fully understands the risk that these securities carry. The investor should only use money that they. Trading penny stocks is likely not advisable for beginners, as they are often very volatile, difficult to research, and can be challenging to trade. It may be.